(Bloomberg) -- Subscribe to Economics Daily for the latest news and analysis.

Treasury Secretary Scott Bessent’s debt-management team is expected to keep the department’s plans for sales of longer-dated securities steady, especially after recent swings in the $29 trillion market.

Despite having criticized his predecessor Janet Yellen for tilting US debt toward short-dated Treasuries, Bessent since taking office in January has said the department is “a long way” from replacing them with longer-term debt. Accordingly, Wall Street expects no changes in Wednesday’s announcement of projected auction sizes for the May-to-July quarter.

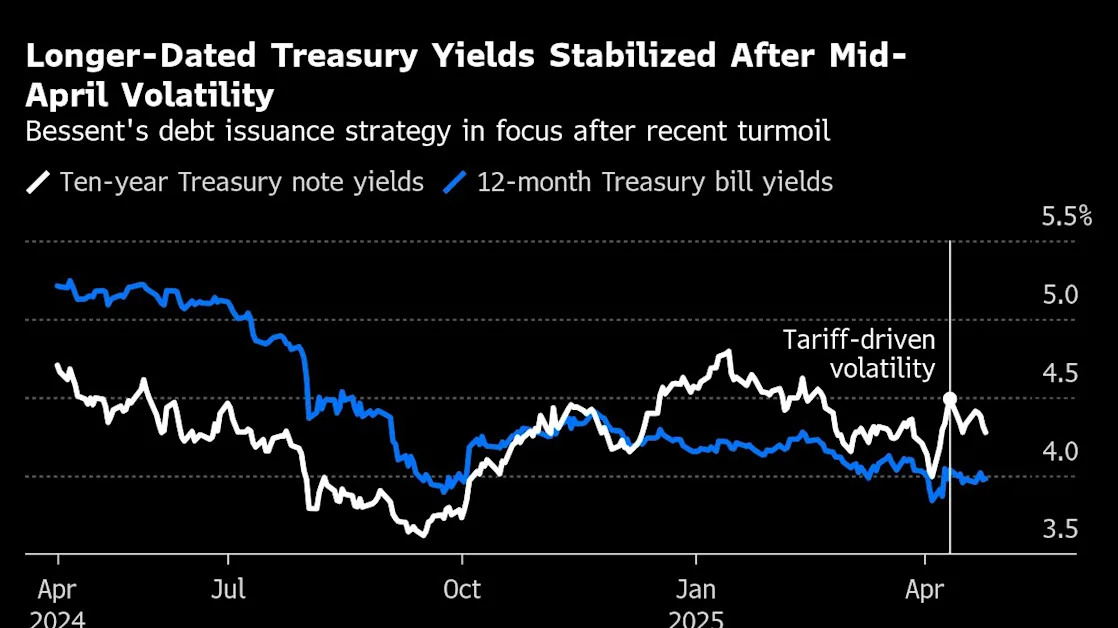

The steepest increases in long-term Treasury yields in decades earlier this month have only raised the stakes for Bessent, who has zeroed in on a goal of suppressing long-term yields. The quarterly supply announcement traditionally has been used to convey guidance on how auction sizes are likely to evolve.

“Given the volatility in the Treasury market, Treasury Secretary Bessent is going to be very careful about how he communicates any changes — especially to coupon sizes,” Subadra Rajappa, head of US rates strategy at Societe Generale, said in a phone interview.

The most recent announcement on Feb. 5 — the first of Bessent’s tenure — retained the Yellen-era guidance anticipating steady note and bond auction sizes “for at least the next several quarters.” A Treasury spokesperson didn’t respond Friday to a request for comment on the department’s issuance plans.

Based on the historical pattern, Wednesday’s announcement will set the size of next week’s so-called quarterly refunding auctions, which include 3-, 10- and 30-year maturities. It also will project the sizes for all the other note and bond auctions through the end of July.

If no changes are made, next week’s auctions will total $125 billion and include:

Debt Limit

Further constraining the Treasury from altering its path is the federal debt limit. Staying under the debt cap until Congress increases or suspends it has required the government to reduce issuance of bills, which mature in up to a year, and draw down its cash balance. When possible, bill supply will be increased to replenish the cash stockpile.

The Treasury may opt to provide guidance in Wednesday’s announcement about debt-limit considerations, including an estimate for when its resources will run out without an increase or suspension. Wall Street’s estimates fall in the August-to-October window, though that could change based on the release Monday at 3 p.m. of estimates for the government’s financing needs and cash-balance trajectory through September.

Treasury bill supply became a flashpoint during the 2024 presidential election, when Republicans including Bessent charged Yellen with curbing longer-maturity debt sales to suppress key market interest rates and support the economy ahead of the November election. Bills as a share of outstanding debt increased, exceeding the 15%-to-20% range that the Treasury Borrowing Advisory Committee, comprising investors, dealers and other market participants, had previously recommended. But both TBAC and Yellen and her team pushed back against the criticism.

While auction sizes for some Treasury securities — the seven-year and 20-year tenors in particular — are well off peak levels reached in 2021, others are at record levels, including the benchmark 10-year note’s. Increases could cause yields to rise, and Bessent since taking office has said the administration wants them to fall.

As of late Friday, 10-year yield was about 4.24%, more than a quarter percentage point higher than a 12-month bill’s. It fell below 4% in early April for the first time since October after the administration unveiled a tariffs agenda viewed as detrimental to the economy. The subsequent rebound — despite persistent weakness in US equities — suggested investors no longer considered Treasuries a haven from risk.

Forecasts for sustained large US fiscal deficits in coming years explain why many dealers expect eventual increases in Treasury auction sizes. In the meantime, the rapid growth of stablecoins, a variety of cryptocurrency with values pegged to the US dollar, can support higher levels of bill issuance, some Treasury-watchers say.

The Treasury’s quarterly survey of dealers, in preparation for Wednesday’s announcement, asked about demand for Treasury securities as a reserve asset for stablecoins. JPMorgan Chase & Co. estimated that $114 billion of Treasury bills backed stablecoins at the end of last year, less than 2% of the $6 trillion outstanding.

Still, “the rapid growth of the stablecoin industry” means it could become a “significant player” in money markets, TD Securities strategists led by Gennadiy Goldberg said in a note. If there’s no change in guidance on Wednesday, “we believe markets will interpret that as Treasury willing to rely more on bills,” with positive implications for longer-dated securities, they wrote.

T-Bill Demand

JPMorgan strategists led by Jay Barry said “we would not be surprised” if the Treasury charges the TBAC with analyzing the question of increased stablecoin demand for T-bills. Bessent at a closed-door JPMorgan event last week said stablecoins could be a big source of demand for Treasuries.

“It would be one reason to maintain a higher bill share than average, and we do think there is room for substantial growth here,” Barry’s group wrote in a note last week. “This path of policy analysis could be a credible reason to hold off increasing auction sizes into 2026.”

By contrast, measures to shrink the average maturity of outstanding Treasuries, or conducting buybacks of older debt — which Bessent April 14 said was a possible remedy for stabilizing the market — “could be perceived to be gimmicky,” the JPMorgan team wrote — and likely result in higher, not lower yields.

JPMorgan’s base case is for the Treasury to resume boosting the size of coupon auctions starting in November, but “reading the tea leaves from Secretary Bessent since he took office,” the risk is that’s delayed to 2026.

--With assistance from Daniel Flatley.