Cruise company Norwegian Cruise Line (NYSE:NCLH) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 2.9% year on year to $2.13 billion. Its non-GAAP profit of $0.07 per share was 22.9% below analysts’ consensus estimates.

Is now the time to buy Norwegian Cruise Line? Find out in our full research report .

Norwegian Cruise Line (NCLH) Q1 CY2025 Highlights:

“We kicked off 2025 with solid first quarter results, demonstrating the continued momentum of our Charting the Course strategy in building a strong foundation for long-term success and delivering on our vision for guests to Vacation Better | Experience More," said Harry Sommer, president and chief executive officer of

Company Overview

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

Sales Growth

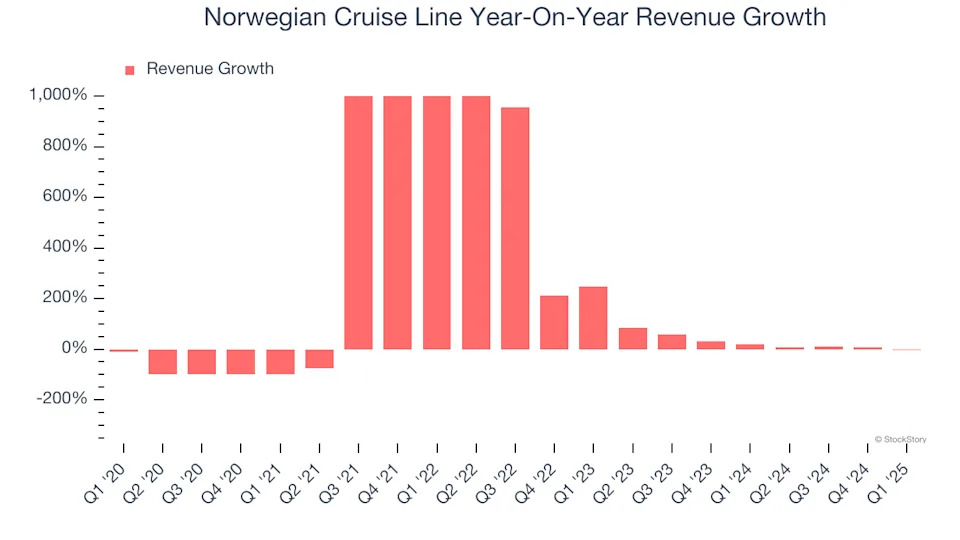

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Norwegian Cruise Line’s 8.3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Norwegian Cruise Line’s annualized revenue growth of 23.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Norwegian Cruise Line’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Norwegian Cruise Line also discloses its number of passenger cruise days, which reached 5.79 million in the latest quarter. Over the last two years, Norwegian Cruise Line’s passenger cruise days averaged 2.4% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Norwegian Cruise Line missed Wall Street’s estimates and reported a rather uninspiring 2.9% year-on-year revenue decline, generating $2.13 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 10.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

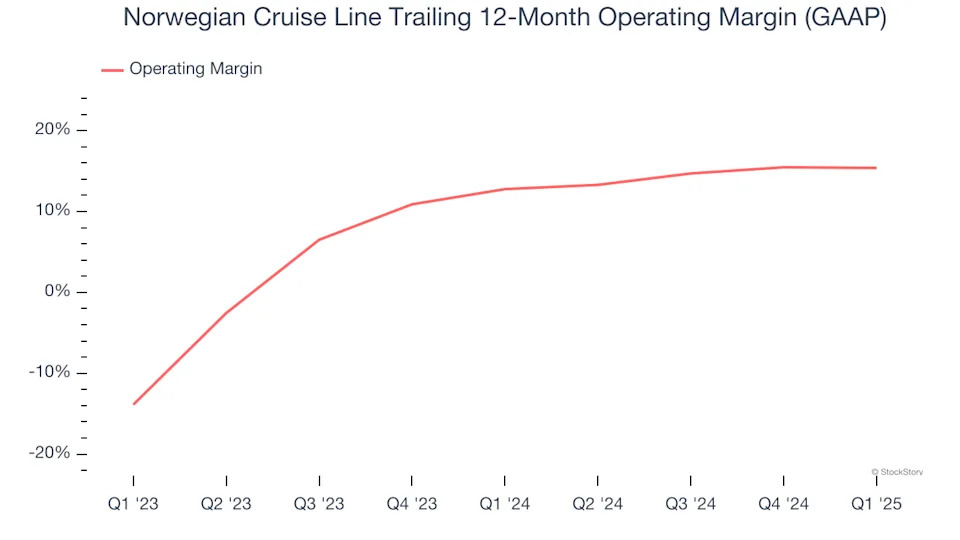

Norwegian Cruise Line’s operating margin has risen over the last 12 months and averaged 14.1% over the last two years. Its solid profitability for a consumer discretionary business shows it’s an efficient company that manages its expenses effectively.

This quarter, Norwegian Cruise Line generated an operating profit margin of 9.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

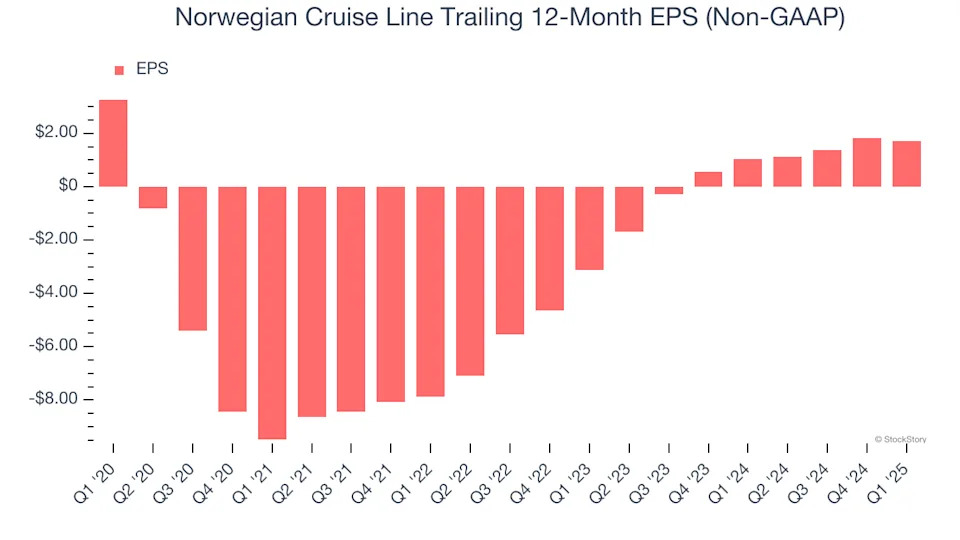

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Norwegian Cruise Line, its EPS declined by 12.1% annually over the last five years while its revenue grew by 8.3%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q1, Norwegian Cruise Line reported EPS at $0.07, down from $0.16 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Norwegian Cruise Line’s full-year EPS of $1.72 to grow 23.5%.

Key Takeaways from Norwegian Cruise Line’s Q1 Results

It was encouraging to see Norwegian Cruise Line beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS missed significantly and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.9% to $16 immediately after reporting.

The latest quarter from Norwegian Cruise Line’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .