Key Takeaways

President Trump campaigned on shaking up the status quo. His first 100 days have delivered Wall Street a shake-up and then some.

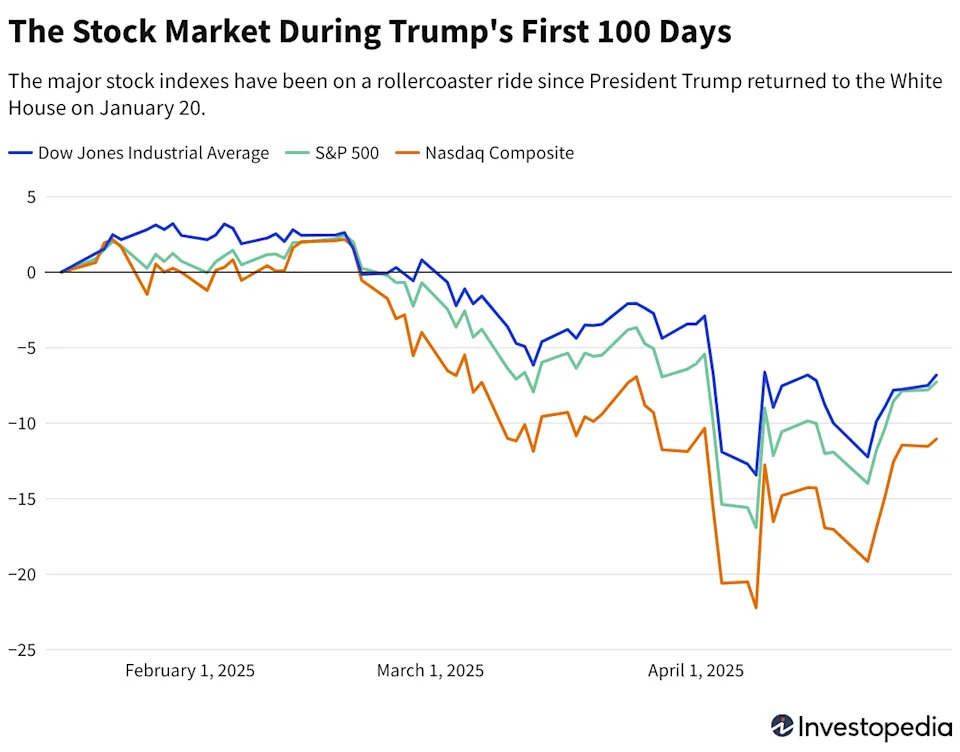

Stocks have been on a wild ride since Trump’s inauguration. The S&P 500 endured one of its worst sell-offs in decades earlier this month after Trump unveiled his “Liberation Day” tariffs on April 2. A week later, when Trump announced a 90-day pause on most of those duties, stocks staged their biggest rally since 2008 .

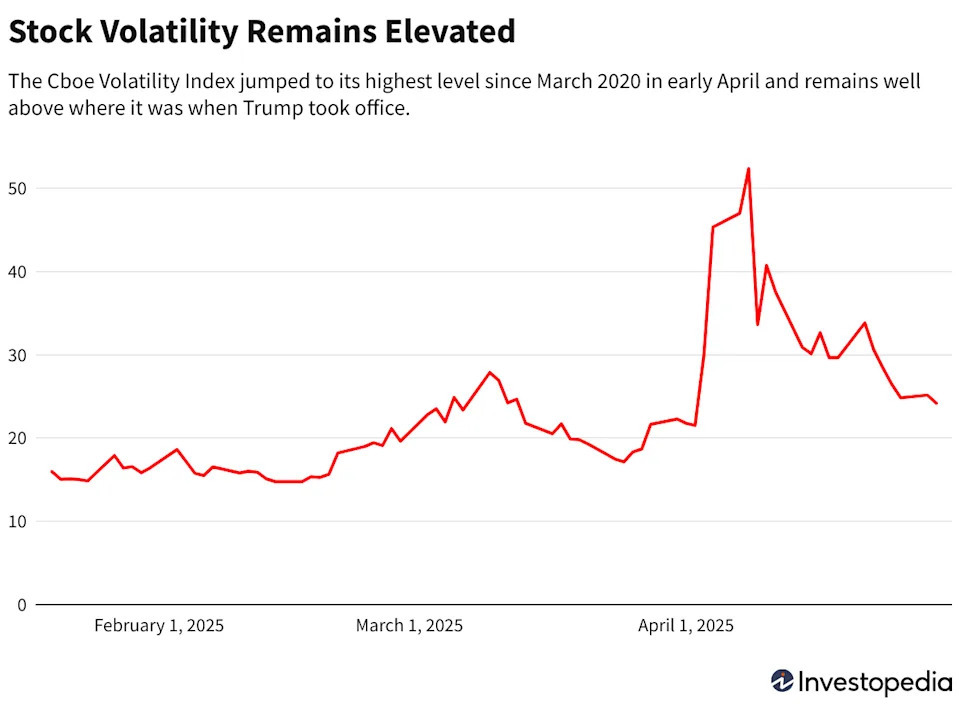

The Cboe Volatility Index ( VIX ), otherwise known as “the fear index,” closed at its highest level since March 2020 the day before the “Liberation Day” tariffs went into effect. The index has come down from its recent highs, but as of Tuesday sat nearly 10 points—or about 50%—above where it was when Trump took office.

Stocks, which are riding a six-day winning streak , have regained nearly all of their “Liberation Day” losses. Though, with tariffs on China still 145% higher than at the start of the year and no major trade deals announced since the tariffs were paused, uncertainty remains high on Wall Street.

Bonds and the Dollar Haven't Fared Much Better

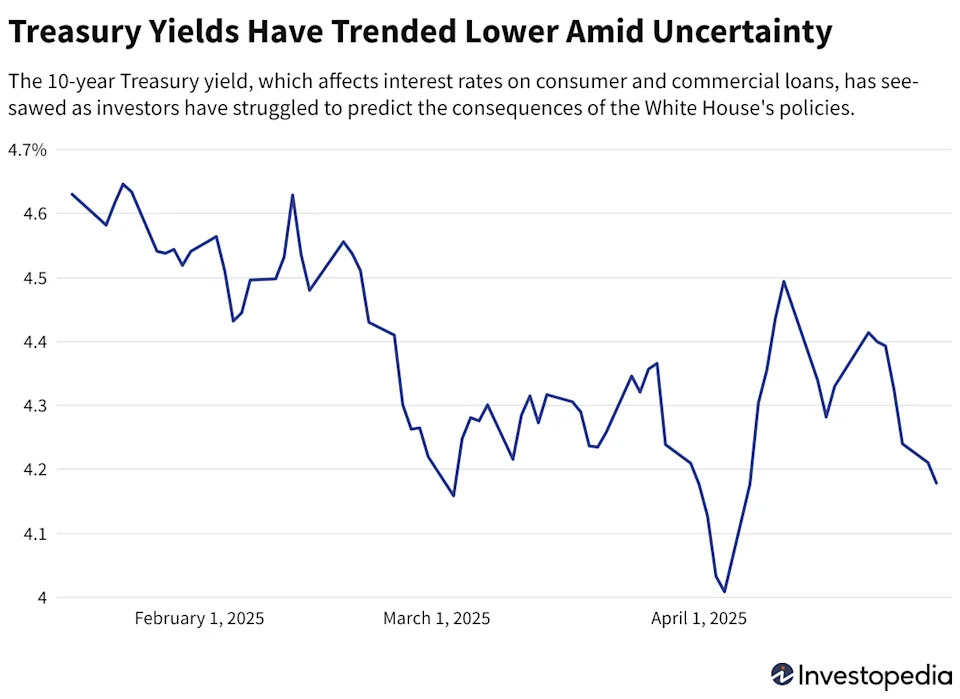

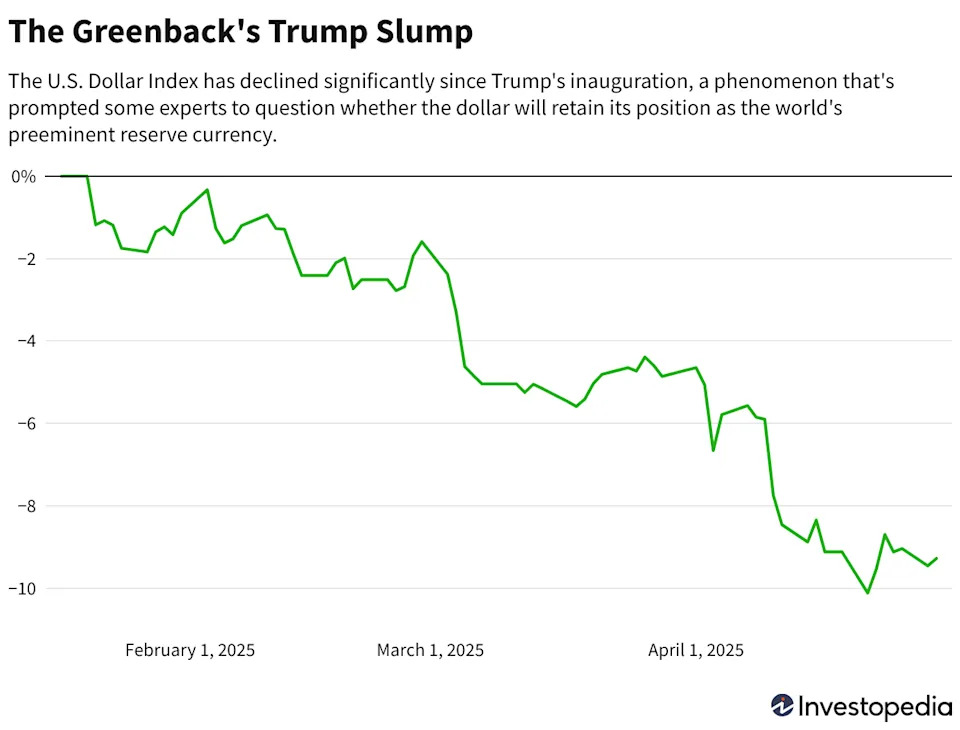

Trump’s tariffs have also rattled bond and currency markets. Treasury yields slid throughout the first months of Trump’s second term as investors got their first taste of the president’s unpredictable, ever-shifting trade policy. Economists warned tariffs would deal a blow to economic growth and raise prices; uncertainty about the tariffs and their fallout spurred a sharp drop in consumer and business confidence.

The 10-year Treasury yield slumped to a 6-month low around the time of “Liberation Day” as stock market chaos drove investors into the relative safety of bonds. Then something unexpected happened: yields surged as bonds sold off despite no discernible change in the tariff or economic outlooks.

At the same time, the U.S. dollar, which one would expect to rise with Treasury yields, slumped . The simultaneous sell-off of Treasury debt and U.S. dollars—two long-time safe havens for global investors—prompted some experts to wonder whether the world was responding to Trump’s tariffs by shunning U.S.-based assets , a phenomenon analysts dubbed the “Sell America” trade.

Investors Search for Safety in Gold and... Bitcoin?

Amid all the economic uncertainty of the past few months, two assets have stood out from the rest: gold and bitcoin.

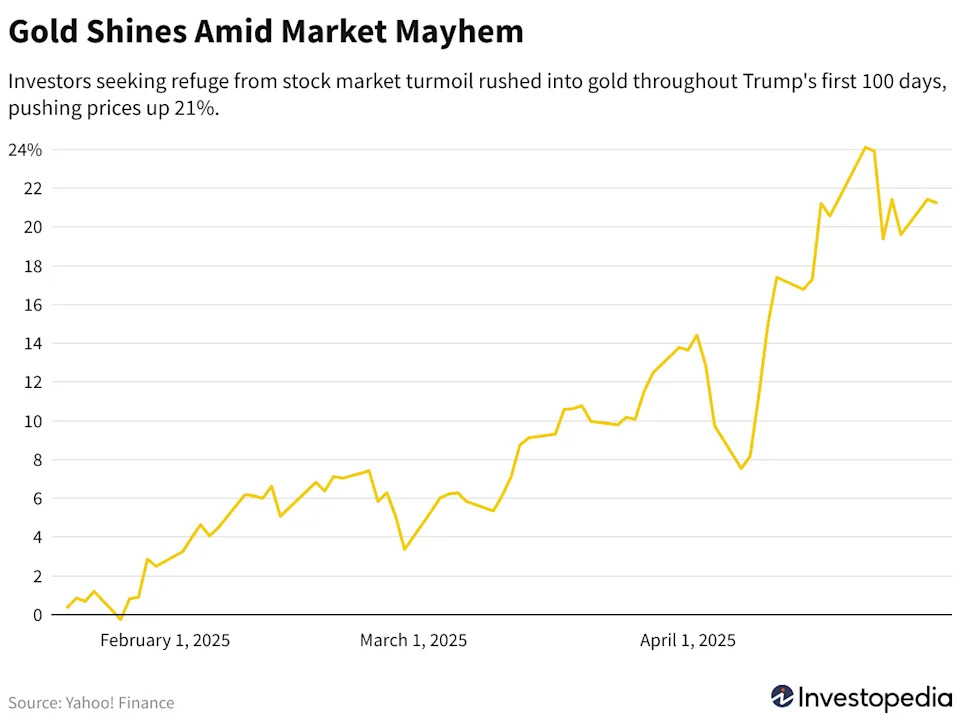

Gold prices have soared to record highs this year amid a flight to country- and currency-neutral safe havens. Gold on Tuesday traded at around $3,325 an ounce, up more than 21% since Trump’s inauguration.

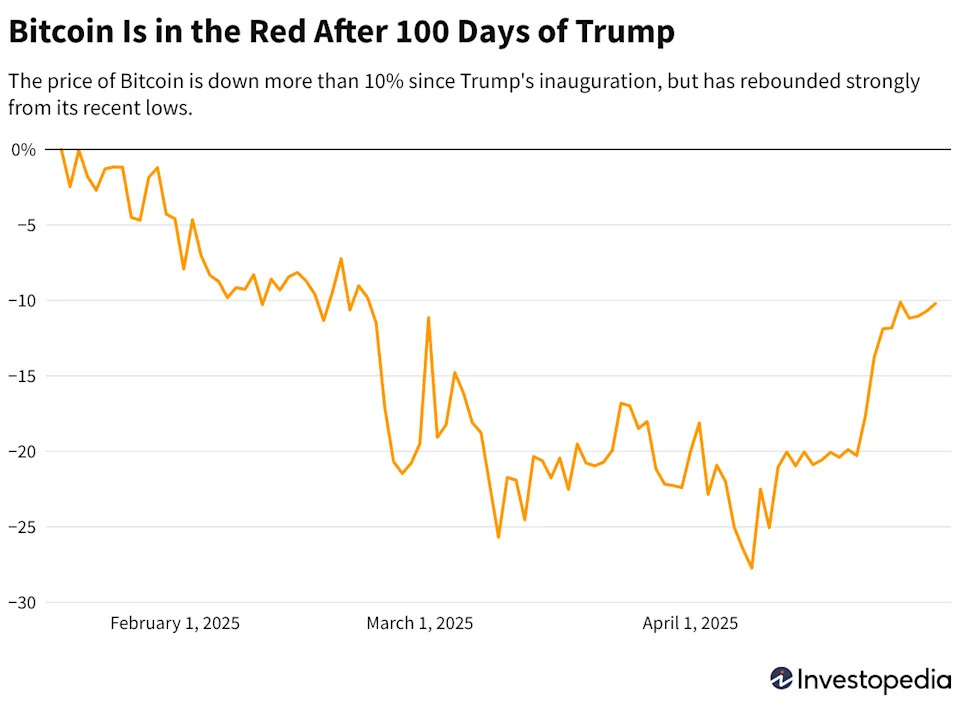

Bitcoin has, compared to gold, had a difficult year so far; the cryptocurrency on Tuesday was down more than 10% since Trump took office. But bitcoin faithful have been encouraged by what they’re seeing below the surface—namely, that the correlation between bitcoin and stocks has weakened.

Crypto advocates have long referred to bitcoin as “digital gold,” citing its limited supply and potential as an inflation hedge. But for much of its recent history, bitcoin has moved in tandem with tech stocks, selling off amid growth scares and soaring when risk appetite is high. Amid the recent turmoil, however, bitcoin and stocks have occasionally moved in opposite directions, evidence to some investors that the cryptocurrency is finally showing its worth as a safe haven.

Read the original article on Investopedia