Bedding manufacturer and retailer Sleep Number (NASDAQ:SNBR) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 16.4% year on year to $393.3 million. Its GAAP loss of $0.38 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Sleep Number? Find out in our full research report .

Sleep Number (SNBR) Q1 CY2025 Highlights:

Linda Findley, President and CEO, commented, “We are laser focused on delivering strong returns for shareholders and are taking a different approach to the Sleep Number business. I see a way to run our business on a lower cost basis without compromising our topline. We are fundamentally changing how we operate. We implemented an organizational redesign, including changes to our leadership team, to simplify decision making and bring us closer to the customer. With that change, we reduced corporate management roles by 21%. In addition, we are reshaping key functions within the company, including marketing and research and development, to further drive efficiency. Since I joined three weeks ago, our efforts have reduced second quarter operating expenses by approximately 10% of our current cost structure, as of the first quarter of 2025. "

Company Overview

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.61 billion in revenue over the past 12 months, Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

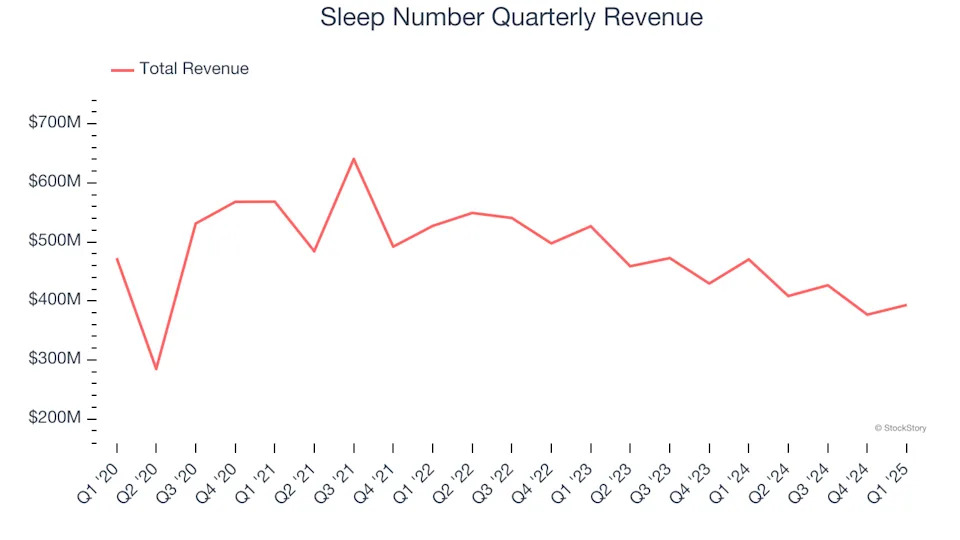

As you can see below, Sleep Number struggled to increase demand as its $1.61 billion of sales for the trailing 12 months was close to its revenue six years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores and observed lower sales at existing, established locations.

This quarter, Sleep Number missed Wall Street’s estimates and reported a rather uninspiring 16.4% year-on-year revenue decline, generating $393.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.2% over the next 12 months, a slight deceleration versus the last six years. This projection is underwhelming and suggests its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

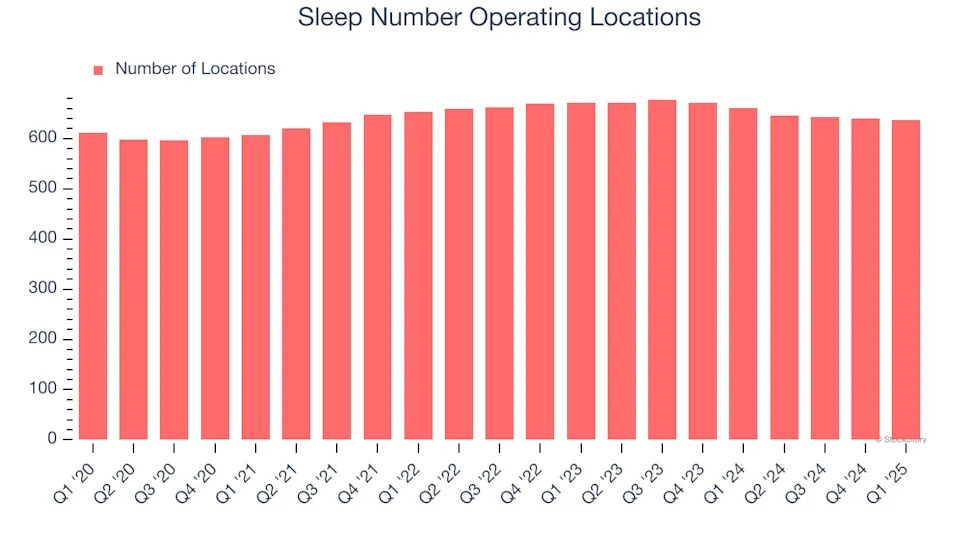

Sleep Number listed 637 locations in the latest quarter and has generally closed its stores over the last two years, averaging 1.8% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

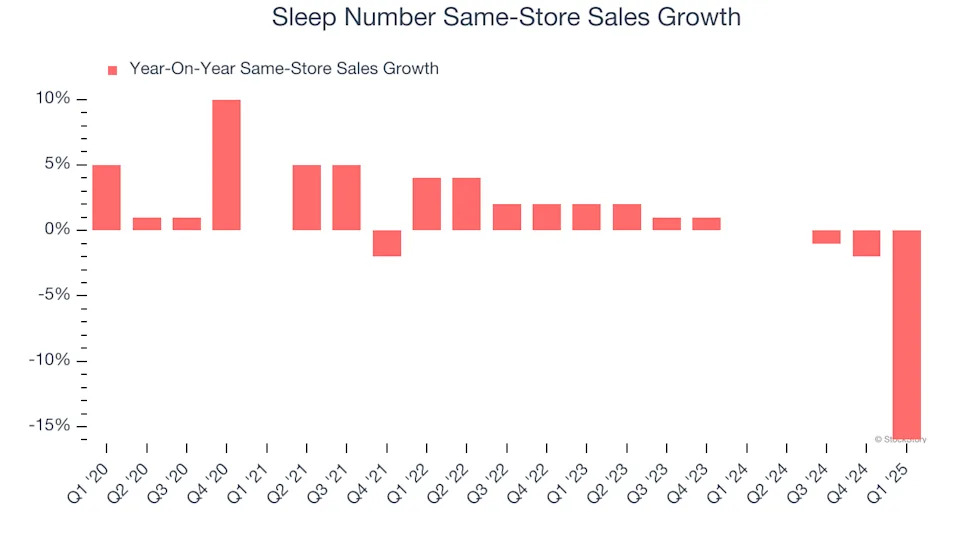

Sleep Number’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines. This performance isn’t ideal, and Sleep Number is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Sleep Number’s same-store sales fell by 16% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Sleep Number’s Q1 Results

We enjoyed seeing Sleep Number beat analysts’ gross margin expectations this quarter. On the other hand, its EBITDA missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 7.4% to $7.21 immediately after reporting.

The latest quarter from Sleep Number’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .