Freight delivery company Heartland Express (NASDAQ:HTLD) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 18.8% year on year to $219.4 million. Its GAAP loss of $0.18 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Heartland Express? Find out in our full research report .

Heartland Express (HTLD) Q1 CY2025 Highlights:

Heartland Express Chief Executive Officer Mike Gerdin commented on the quarterly operating results and ongoing initiatives of the Company, "Our consolidated operating results for the three months ended March 31, 2025, reflect a combination of adverse weather experienced in January and February, tariff uncertainties amongst our customers in March, along with prolonged industry-wide challenges where operating cost inflation continued to outpace customer freight demand and freight rate improvements. Internally, our four operating brands have delivered current financial results based on their respective time within our legacy operating model - Heartland Express, Millis Transfer, Smith Transport, and Contract Freighter's, Inc. (CFI), respectively. Our Heartland Express brand was profitable during the three months ended March 31, 2025, but did not reflect the operating ratio and financial results that we have expected and delivered in past periods. However, we believe Heartland Express has continued to operate in line with the best full truckload carriers in our industry. The other three operating brands experienced under-utilized assets, operating cost growth, and driver retention challenges that hindered operational performance, resulting in a lack of profitability during the first quarter of 2025. We are strategically shrinking the fleet in order to right size to freight demand along with evaluating all cost measures for opportunities for efficiency. We believe that cost improvements and transportation system changes, which are already underway or planned for each of these brands, will provide a better cost structure and operating visibility to deliver a path toward operating profitability for our consolidated operations over the next twelve months. While we have begun to see encouraging signs pointing to the early stages of a potential freight market recovery, we do not expect material improvements until later in 2025."

Company Overview

Founded by the son of a trucker, Heartland Express (NASDAQ:HTLD) offers full-truckload deliveries across the United States and Mexico.

Sales Growth

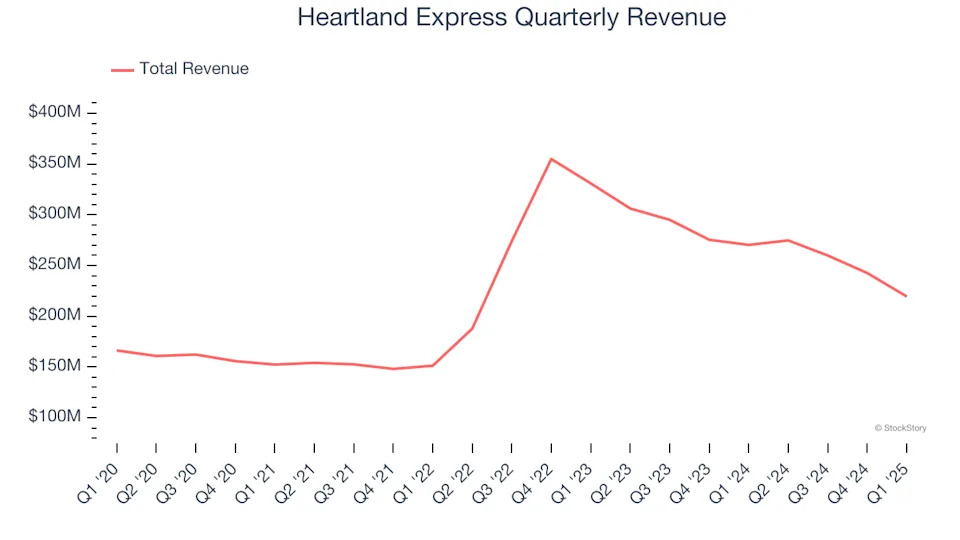

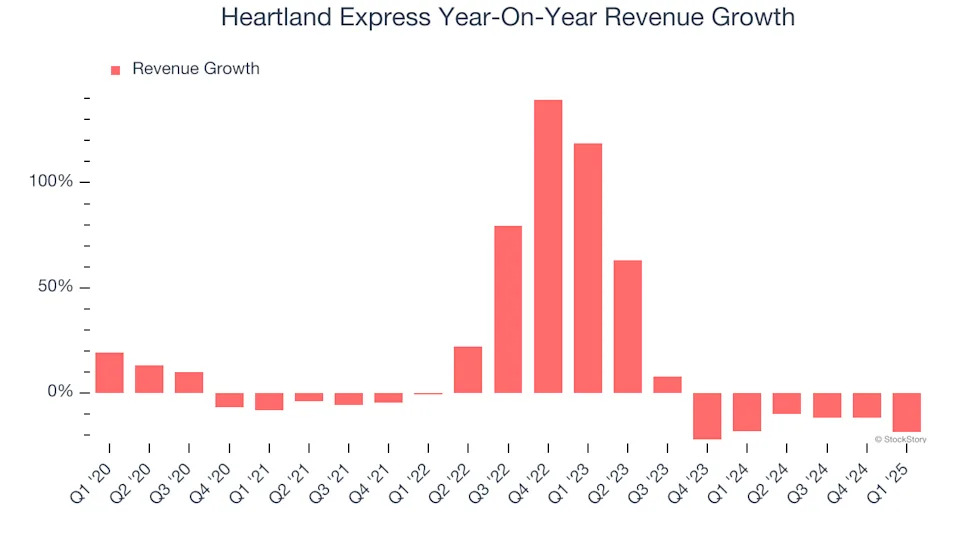

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Heartland Express’s 9.8% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Heartland Express’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.8% over the last two years. Heartland Express isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Heartland Express missed Wall Street’s estimates and reported a rather uninspiring 18.8% year-on-year revenue decline, generating $219.4 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

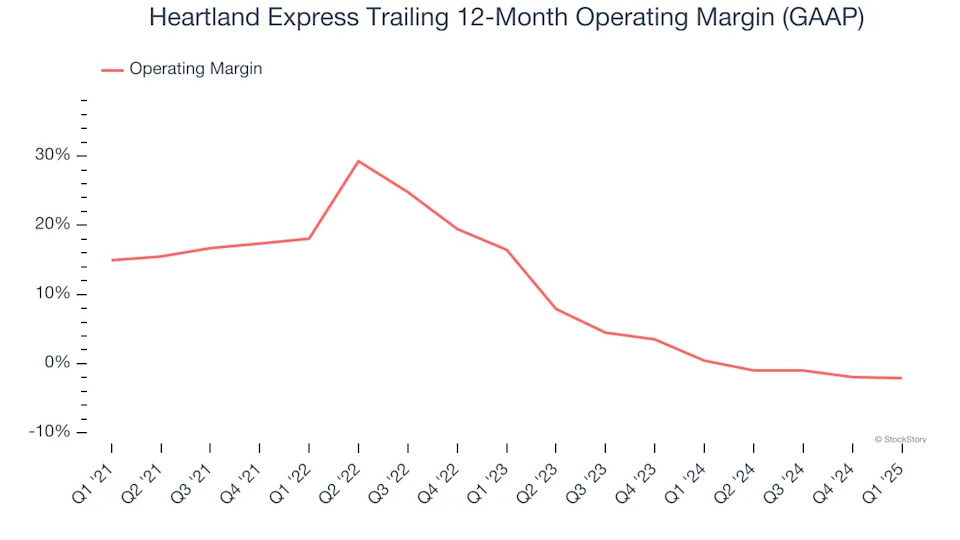

Heartland Express has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.3%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Heartland Express’s operating margin decreased by 17 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Heartland Express generated an operating profit margin of negative 6.8%, down 1.5 percentage points year on year. The reduction is quite minuscule and shareholders shouldn’t weigh the results too heavily.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

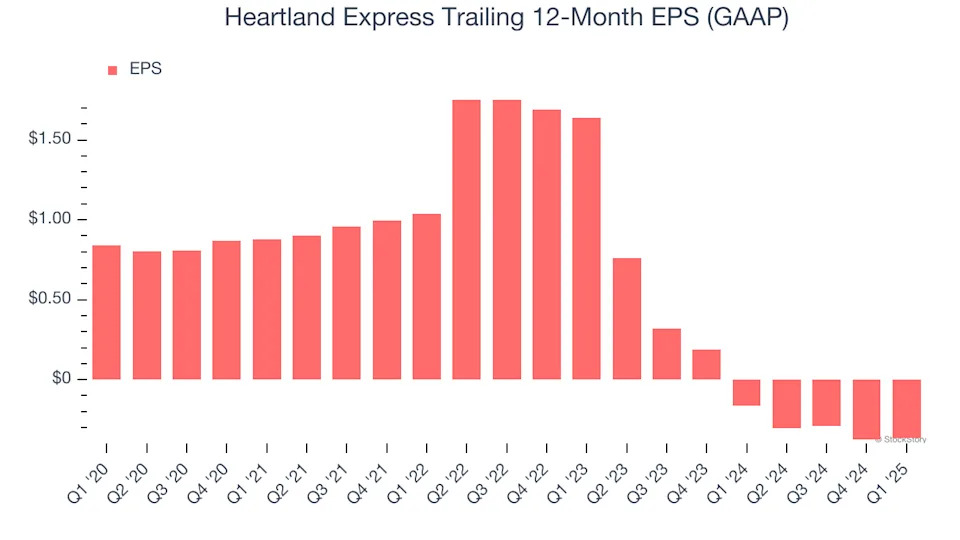

Sadly for Heartland Express, its EPS declined by 19.5% annually over the last five years while its revenue grew by 9.8%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Heartland Express’s earnings can give us a better understanding of its performance. As we mentioned earlier, Heartland Express’s operating margin declined by 17 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Heartland Express, its two-year annual EPS declines of 49.1% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q1, Heartland Express reported EPS at negative $0.18, up from negative $0.19 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Heartland Express’s full-year EPS of negative $0.37 will reach break even.

Key Takeaways from Heartland Express’s Q1 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $7.60 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .