RingCentral’s stock price has taken a beating over the past six months, shedding 30% of its value and falling to $25.50 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in RingCentral, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Why Is RingCentral Not Exciting?

Despite the more favorable entry price, we're cautious about RingCentral. Here are three reasons why RNG doesn't excite us and a stock we'd rather own.

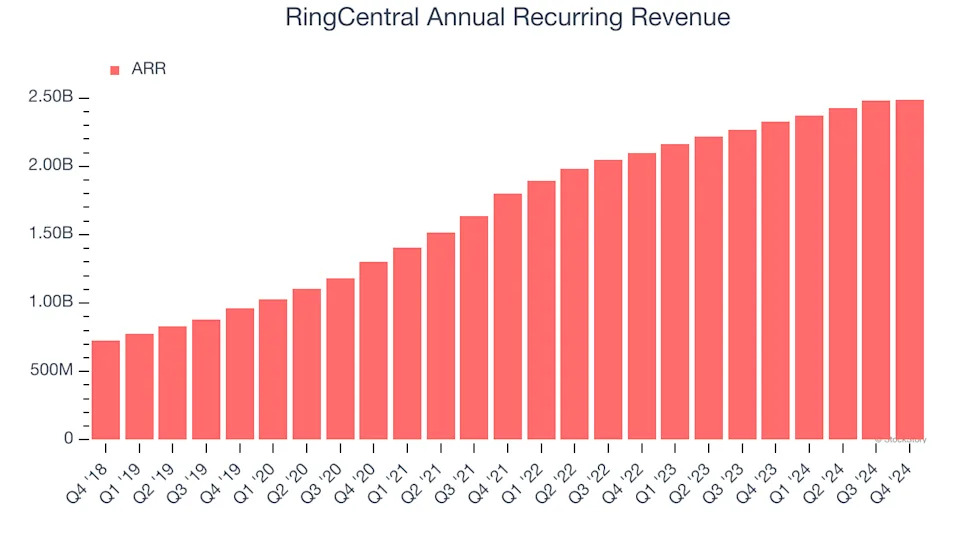

1. Weak ARR Points to Soft Demand

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

RingCentral’s ARR came in at $2.49 billion in Q4, and over the last four quarters, its year-on-year growth averaged 8.9%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

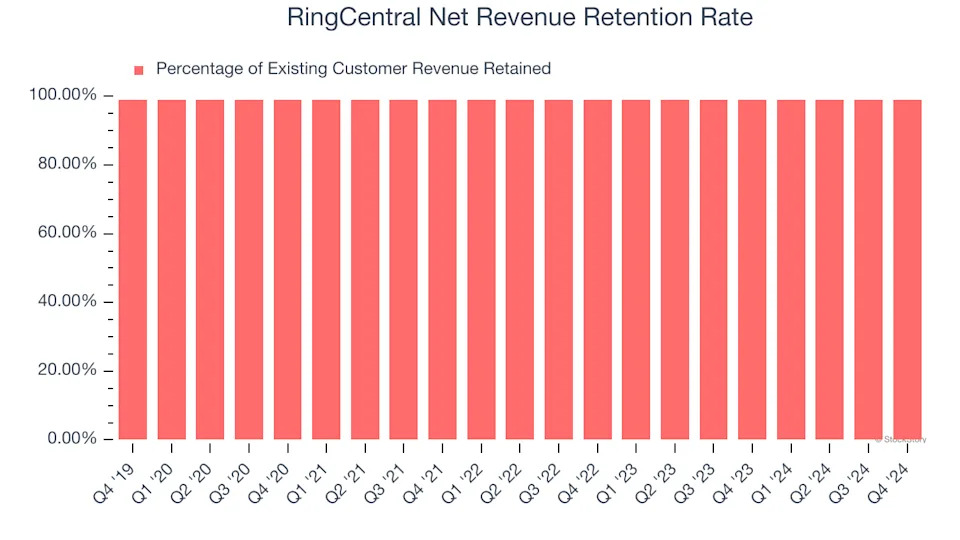

2. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

RingCentral’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 99.1% in Q4. This means RingCentral would’ve grown its revenue by -0.9% even if it didn’t win any new customers over the last 12 months.

RingCentral has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect RingCentral’s revenue to rise by 4.6%, a deceleration versus its 14.6% annualized growth for the past three years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Final Judgment

RingCentral isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 0.9× forward price-to-sales (or $25.50 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a top digital advertising platform riding the creator economy .

Stocks We Like More Than RingCentral

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .