Aerospace and defense company Leonardo DRS (NASDAQ:DRS) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 16.1% year on year to $799 million. The company expects the full year’s revenue to be around $3.48 billion, close to analysts’ estimates. Its non-GAAP profit of $0.20 per share was 21.1% above analysts’ consensus estimates.

Is now the time to buy Leonardo DRS? Find out in our full research report .

Leonardo DRS (DRS) Q1 CY2025 Highlights:

“Our first quarter 2025 financial results exceeded our expectations and reflect a solid start to the year. Our differentiated portfolio continues to exhibit strong customer demand, which is also translating into healthy organic revenue growth. Additionally, in the quarter we drove improved profitability and reduced free cash flow usage compared to last year. Amidst a more dynamic operating environment, we remain focused on maintaining sharp execution throughout 2025 to meet our commitments to shareholders and customers,” said Bill Lynn, Chairman and CEO of Leonardo DRS.

Company Overview

Developing submarine detection systems for the U.S. Navy, Leonardo DRS (NASDAQ:DRS) is a provider of defense systems, electronics, and military support services.

Sales Growth

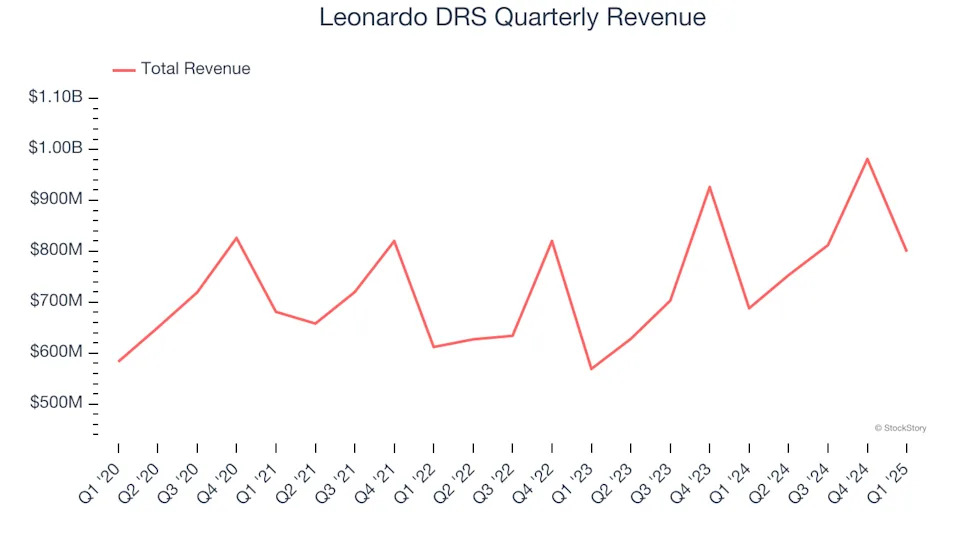

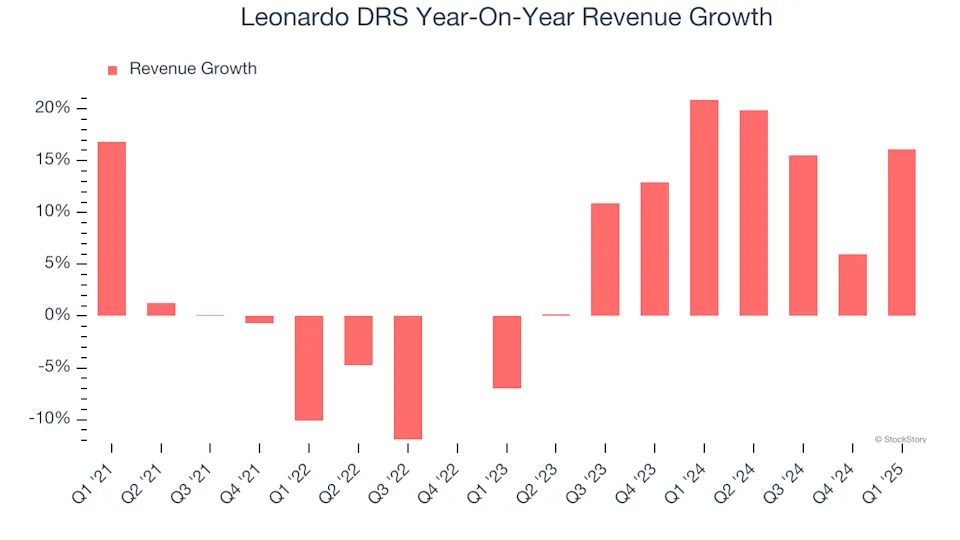

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last four years, Leonardo DRS grew its sales at a sluggish 3.8% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Leonardo DRS’s annualized revenue growth of 12.4% over the last two years is above its four-year trend, suggesting its demand recently accelerated.

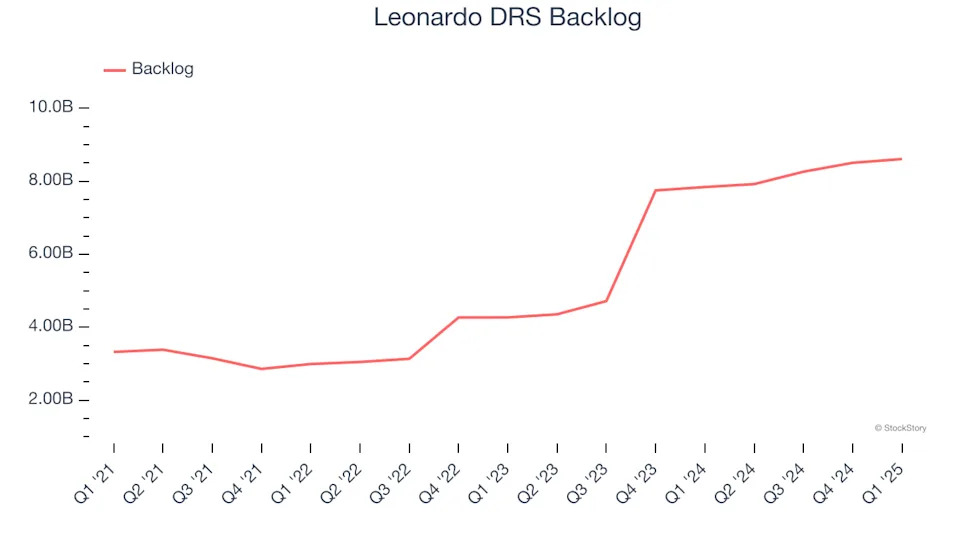

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Leonardo DRS’s backlog reached $8.61 billion in the latest quarter and averaged 54.4% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Leonardo DRS’s products and services but raises concerns about capacity constraints.

This quarter, Leonardo DRS reported year-on-year revenue growth of 16.1%, and its $799 million of revenue exceeded Wall Street’s estimates by 9.2%.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

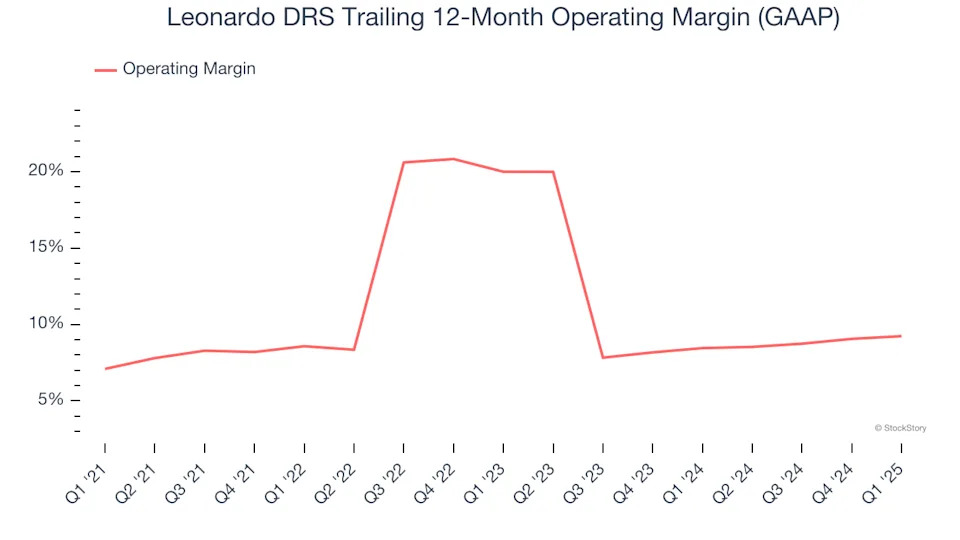

Leonardo DRS has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.5%.

Analyzing the trend in its profitability, Leonardo DRS’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, Leonardo DRS generated an operating profit margin of 7.4%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

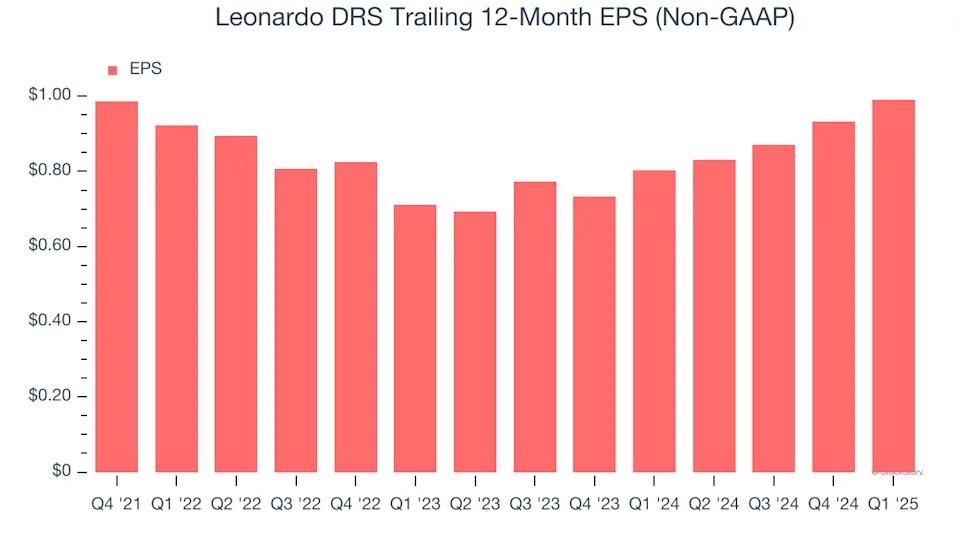

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Leonardo DRS’s EPS grew at an astounding 18% compounded annual growth rate over the last two years, higher than its 12.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Leonardo DRS’s earnings quality to better understand the drivers of its performance. Leonardo DRS’s operating margin has expanded by 3 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Leonardo DRS reported EPS at $0.20, up from $0.14 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Leonardo DRS’s full-year EPS of $0.99 to grow 9.9%.

Key Takeaways from Leonardo DRS’s Q1 Results

We were impressed by how significantly Leonardo DRS blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 6.3% to $39.29 immediately after reporting.

Leonardo DRS put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .