The US stock market's best times are behind it, according to Christopher Wood, global head of equity strategy at Jefferies.

The longtime strategist said he believed that the US market had likely already passed its peak, with stocks hitting an all-time high relative to the rest of the world's markets on Christmas Eve of last year, he estimated.

That's partly because Trump's tariffs have done permanent damage to America's brand, Wood said, referring to the US's reputation as a safe haven .

"I have been stating since the start of the year that my base case, until proven wrong, is that US equities reached an all-time peak of MSCI All Countries World Index on Christmas Eve last year," Wood said, speaking to Bloomberg on Wednesday.

That damage is already evident in financial markets.

For one, the US Dollar Index , which weights the greenback against a basket of other currencies, has cratered since Trump first unveiled tariffs on April 2, with the index now trading 8% lower year-to-date.

Wood wrote in a note to clients last month that the US dollar's dominance in financial markets is the main reason America is "truly exceptional," though its value likely peaked when Trump returned to the White House this year.

Second, the US market accounted for around 67% of the world market last year. That's an "extreme" share, even when the US economy is doing well, Wood said.

Third, the S&P 500 was trading at an all-time high in terms of price-to-sales among the index's companies, a sign that valuations were stretched.

And finally, talk of American exceptionalism — the idea that the US will continue to outperform international markets — also picked up in the fourth quarter of last year. That was another signal that equities were nearing a "massive top," Wood said.

Stocks have rallied this week, partly out of hope that Trump will announce a massive "U-turn" on his tariffs policy, Wood said. But, even if the president walks back most of his tariffs, the damage from Trump's trade policy is likely permanent, Wood added, noting there was already noting that there was already a "much better catalyst" for traders to buy stocks in other areas of the world.

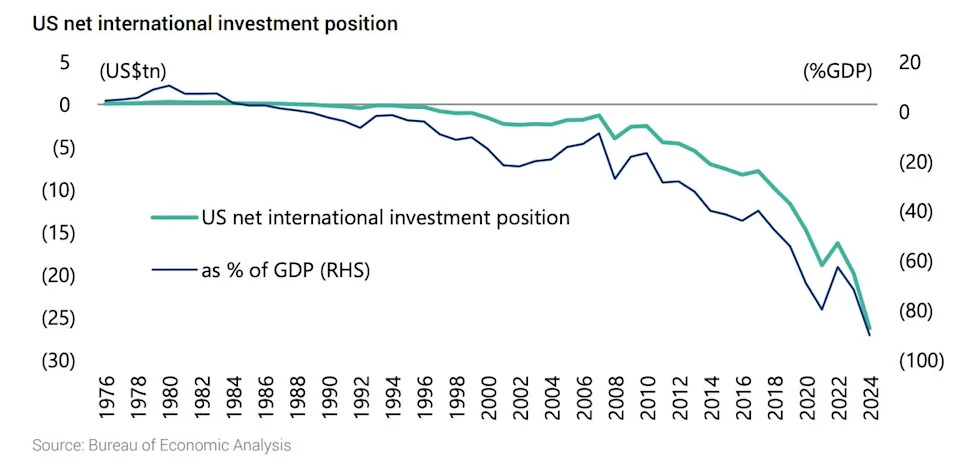

In a note to clients last month, he added that international net investment in the US had plunged in recent years.

"The question in the US is, do you avoid this negative catalyst of higher tariffs?" Wood said.

"I would be adding to China, Japan, Europe, and India. That's where global investors should be diversifying away from the US," he said.

While Wood says he never believed in American exceptionalism in a traditional sense, other commentators on Wall Street have floated concerns that the US exceptionalism trade could be waning among investors as faith in US assets declines.

Wild moves in stocks and bonds in recent weeks is a sign that the "sell America" trade may be driving the swings as investors look to park their cash elsewhere.

Read the original article on Business Insider