Healthcare services provider BrightSpring Health Services (NASDAQ:BTSG) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 11.7% year on year to $2.88 billion. The company’s full-year revenue guidance of $12.25 billion at the midpoint came in 2.5% above analysts’ estimates. Its non-GAAP profit of $0.19 per share was significantly above analysts’ consensus estimates.

Is now the time to buy BrightSpring Health Services? Find out in our full research report .

BrightSpring Health Services (BTSG) Q1 CY2025 Highlights:

“BrightSpring’s focus on serving patients with quality and efficient care in home and community settings continues to be foundational to the Company’s growth and financial performance,” said Jon Rousseau, Chairman, President, and Chief Executive Officer of the Company.

Company Overview

Founded in 1974, BrightSpring Health Services (NASDAQ:BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

Sales Growth

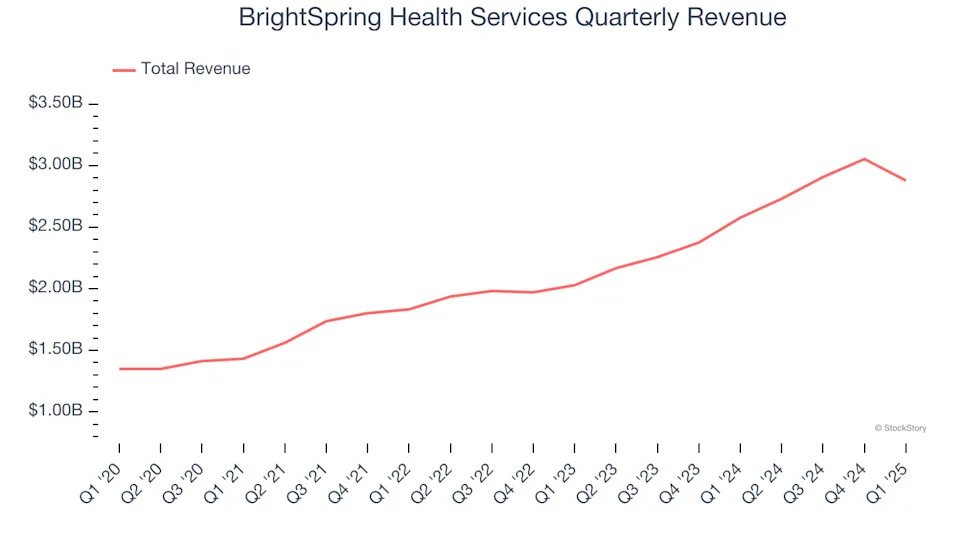

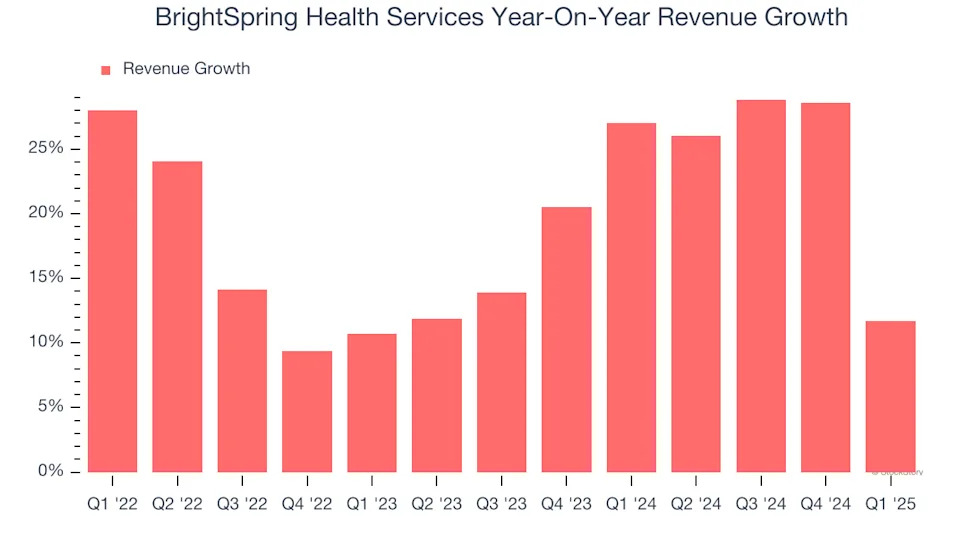

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, BrightSpring Health Services grew its sales at an impressive 18.6% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. BrightSpring Health Services’s annualized revenue growth of 20.9% over the last two years is above its three-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Pharmacy. Over the last two years, BrightSpring Health Services’s Pharmacy revenue averaged 30% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, BrightSpring Health Services reported year-on-year revenue growth of 11.7%, and its $2.88 billion of revenue exceeded Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Operating Margin

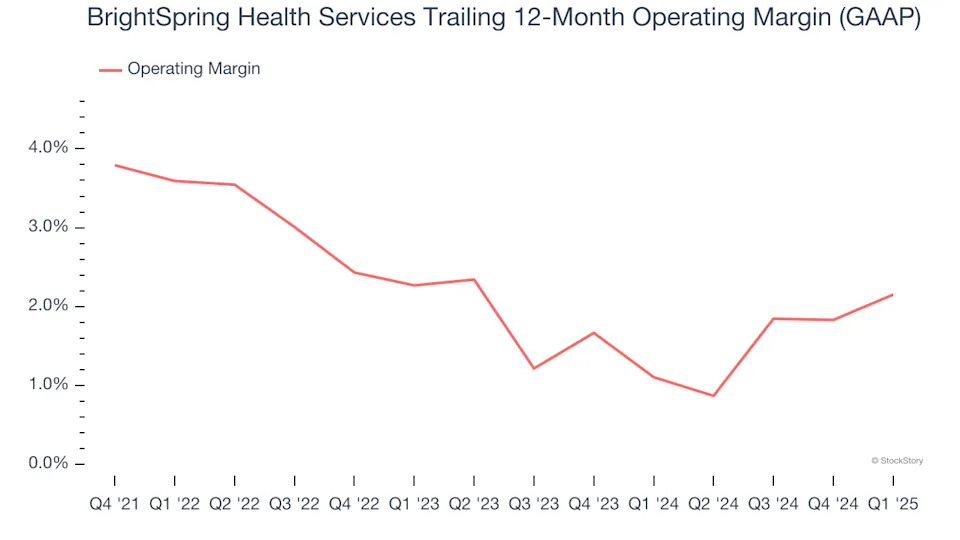

BrightSpring Health Services was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.3% was weak for a healthcare business.

Analyzing the trend in its profitability, BrightSpring Health Services’s operating margin decreased by 1.7 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. We like BrightSpring Health Services and hope it can right the ship.

In Q1, BrightSpring Health Services generated an operating profit margin of 1.8%, up 1.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

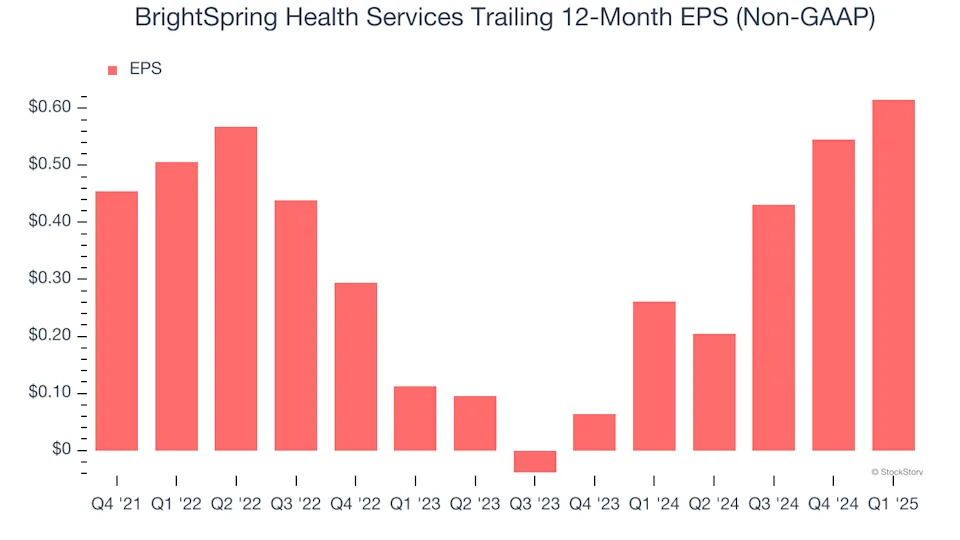

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

BrightSpring Health Services’s EPS grew at a decent 6.8% compounded annual growth rate over the last three years. However, this performance was lower than its 18.6% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

In Q1, BrightSpring Health Services reported EPS at $0.19, up from $0.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects BrightSpring Health Services’s full-year EPS of $0.61 to grow 3.8%.

Key Takeaways from BrightSpring Health Services’s Q1 Results

We were impressed by how significantly BrightSpring Health Services blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 6.4% to $19.03 immediately after reporting.

BrightSpring Health Services put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .