(Bloomberg) -- A mountain of scrap metal in Salt Lake City that had been growing in recent weeks is finally set to shrink, thanks to the temporary truce in the trade dispute between the US and China.

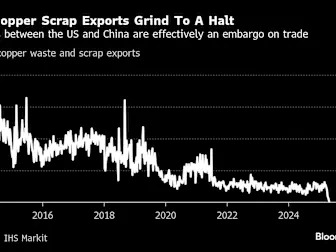

The 300,000 pounds of copper salvaged from old air conditioners, razed buildings and rusty cars has been piling up in the yard at Utah Metal Works Inc. after US shipments to China ground to a halt during the tit-for-tat tariff battle. Now that both countries have agreed to lower their levies for the next three months, the race is on to get the waste metal moving again.

US dealers like Mark Lewon, Utah Metal’s president, and their Chinese counterparts have taken to the phone to seal sales and eventual shipments.

“The biggest thing now is to move material, and then see where things are in 90 days,” Lewon said.

The disruption in the scrap copper world is a snapshot of the wider of chaos across industries unleashed by US President Donald Trump’s trade war, and it shows how supply-chain issues sparked by sweeping tariffs can’t simply be turned off like a light switch. The current pact between China and the US is for a three-month détente while a broader deal is discussed. Trump has said tariffs could go higher again if the countries fail to reach an agreement.

Some of the scrap copper inventory imbalance likely will start to unwind, but analysts are warning it will take some time.

That means there are questions over when both sides will see relief. US scrap yards have been forced to sell metal at record discounts. In China, the repercussions were equally serious as the country’s processors — historically the biggest buyers of US shipments — scrambled for enough raw material.

There is still skepticism over whether the truce will lead to a lasting deal, said Darrell Fletcher, managing director of commodities at Bannockburn Capital Markets. a subsidiary of First Financial Bank, adding “90 days doesn’t exactly change capital expenditure planning or commodity rerouting.”

Copper is viewed as a barometer of the world economy because of its heavy industrial use. Scrap plays a big part of that, accounting for about a third of global supply, especially as mined ore is increasingly coming up short. The metal is a key component for electrification equipment and electric vehicles, which has sent demand higher as prices in the futures market hit record highs in the past 12 months.

The US shipped 600,000 tons of scrap copper in 2024 to help meet increasing demand, making the secondary market equivalent to some of the world’s largest mines. More than half of that went to China.

Then the unraveling of the essential US-China trade flows upended the scrap market. US supplies of the scrap grade known as No. 2 copper have been fetching a discount of 92.5 cents per pound relative to futures, according to data from Fastmarkets. That’s the widest spread ever.

The scrap trade from the US to China has been a major artery in the global copper supply chain for decades. Asian smelters, the processors who take raw copper ore from mines and scrap supplies and turn into the refined metal, got one-fifth of their scrap imports from the US last year. China is by far the biggest producer of refined copper, accounting for more half of global output.

Flows of scrap have become even more important in the past couple of years as a breakneck expansion of China’s smelting capacity stretched the availability of mined ore. Treatment fees — a rough guide to financial pressures on smelters — have plunged deep into negative territory, fueling calls for organized production cuts. Any fresh flows from the US will offer much-needed relief, but it’s not clear that even China’s lowered tariff on US goods will be enough to tease scrap from the stockpiles in America.

“For the copper scrap import business, margins are really thin,” said Xiao Chuankang, an analyst with Chinese researcher Mysteel Global. “So it would be hard to bring in metal at any tariff level.”

Apart from the restrictions on trade, the appetite for US scrap copper also has been impacted by its pricing structure, according to Charles Cooper, head of copper research at Wood Mackenzie. Scrap prices in the US are based on futures trading on the Comex in New York.

Futures have surged above their international benchmarks this year due to expectations of US tariffs specific to the metal. That meant that even while American scrap dealers were dealing with record discounts, the metal was still expensive relative to the global market, discouraging foreign buyers. On Wednesday, copper futures traded on Comex fell 1.9% to $4.635 a pound as of 11:19 a.m. in New York, taking the year-to-date gain to 15%, higher than the roughly 9% advance for copper traded on the London Metal Exchange.

The turmoil has come about because Trump wants the US to gain control of its copper supply. In February, he directed the US Commerce Department to open an investigation into potential copper tariffs for all imports of the commodity. The country relies heavily on foreign shipments of primary metal, even as it exports almost nearly equal amounts of scrap. The nation doesn’t have much smelting capacity to process its domestic scrap.

At Utah Metal Works, Lewon has worked to divert some of the supplies he’s sitting on to Japan and Taiwan. But consumption from other regions wasn’t enough to fill the gap from China.

Lewon said business during the height of the trade tensions felt like a game of musical chairs as he searched for buyers other than China.

“When the music stops, you have to hurry and sit down in a chair, and you don’t always have a chair to sit down in,” said Lewon, a former chair of the Recycled Materials Association, speaking before the US-China truce. “It’s the same thing with the copper. You don’t always have a place to go with it now because China’s out.”

--With assistance from Mark Burton, Winnie Zhu and Martin Ritchie.

(Updates with Comex copper futures prices in the 16th paragraph.)