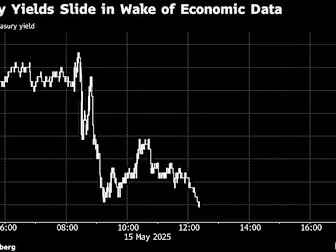

(Bloomberg) -- Treasuries gained as a fresh spate of economic data offered signs of ebbing economic activity and dimming inflation, supporting bets that the Federal Reserve will cut interest rates twice this year.

The bond rally on Thursday sent yields down 10 basis points or more for debt maturing in two to 10 years. Longer-maturity yields also fell after earlier approaching 5% on the heels of several large trades. Swaps traders priced in about 55 basis points of easing for the remainder of 2025. The dollar fell.

The moves come after Wall Street strategists, including those at JPMorgan Chase & Co., this week boosted their yield forecasts as their firms pushed out their expectations for when the Fed will resume easing policy.

“Bad news is good news for the bond market” as Thursday’s data — including producer prices and retail sales — pointed to a weaker economy, said Zachary Griffiths, head of investment-grade and macroeconomic strategy at CreditSights Inc.

Prices paid to US producers unexpectedly declined in April by the most in five years, suggesting companies are absorbing some of the hit from higher tariffs. Meanwhile, growth in US retail sales decelerated notably as consumers pulled back spending on imported goods amid concerns about rising prices from levies.

Two-year yields, which are most sensitive to Fed policy, dropped 10 basis points to 3.95%, while the benchmark 10-year yield dropped by a similar amount to to 4.43%. Investors have been increasingly wary of buying long-term securities given concern about the US fiscal trajectory, and the 30-year yield dropped by a slightly smaller magnitude.

While swaps traders were fully pricing in the Fed’s next reduction for October, the odds in the market were also strong for a move in September. That’s ahead of some Wall Street economists, who pushed out their forecasts for the next cut after the recent cooling in US-China trade tensions.

The rates strategy teams at TD Securities, JPMorgan and Bank of America were among those that boosted their forecasts for Treasury yields over recent days.

In the meantime, Republican lawmakers’ draft plan for sweeping tax cuts has been moving ahead, sparking renewed focus on the US fiscal trajectory, with the package projected to worsen the federal deficit and lift the government’s debt burden.

Jamie Dimon, chief executive officer of JPMorgan Chase, said in a Bloomberg Television interview Thursday that the US deficit and debt load is an issue.

“It creates risk of inflation to me. It creates risk of higher long-term rates,” Dimon said at JPMorgan’s annual Global Markets Conference in Paris. That might slow growth and create a stagflation scenario, he added.

Even higher short-term yields risk causing a hit to the fiscal outlook given US debt managers have hoisted sales of bills in recent years. At least $9.3 trillion of federal debt is slated to mature and roll over within a year – in addition to the approximately $2 trillion that the Treasury will need to issue over the next year to cover the federal deficit, according to the Peterson Foundation.

Traders have received through the week signals from Fed policymakers that they’re comfortable keeping rates unchanged as they await more clarity on how the administration’s trade policy will affect growth and inflation. Last week, the Fed opted to hold rates steady while it waits for further evidence on the strength of the economy.

“Weaker consumer spending and lower inflation could give the Fed some room to ease later in the year if these trends continue,” said David Berson, chief US economist at Cumberland Advisors.

In prepared remarks released on Thursday on the Fed’s framework review, Fed Chair Jerome Powell held off on providing insights on the near-term outlook for monetary policy.

--With assistance from Aline Oyamada and Edward Bolingbroke.

(Updates rates.)