Persistently high fiscal deficits, rising interest expenses and constrained budgetary flexibility are the primary factors driving the upward trajectory of the US general government debt-to-GDP. These dynamics underpinned Scope Ratings (Scope)’s decision to affirm the US’s AA ratings with a Negative Outlook on 9 May 2025 given the presence of several credit strengths. Among them are the resilient economy, deep and liquid capital markets, and the dollar’s primacy as the global reserve currency.

The US general government deficit widened to 7.3% of GDP last year, well above the pre-pandemic average of roughly 4.8% between 2015 and 2019. Scope expects this deficit to remain elevated this year at around 6.4% of GDP and to average around 7% over 2026-2030, driven by rising interest payments and greater funding needs to support entitlement programmes like Social Security, Medicare, and retirement and disability services for military and civil servants. The likely extension of the 2017 Tax Cuts and Jobs Act, additional proposed tax reductions, as well as higher defence and border security spending will further pressure the health of government finances.

Figure 1: Rising public debt is key challenge for sovereign ratings of the US, France, UK

% of GDP

Persistent Primary Budget Deficits and High Interest Payments Drive Up Debt Ratio

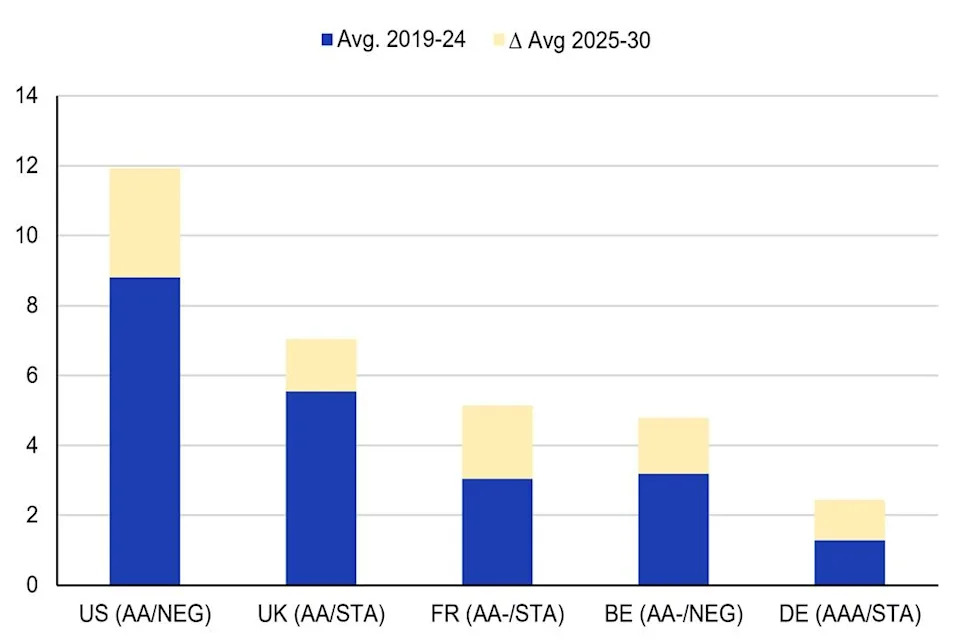

Scope’s projection of an increase in the US general government debt-to-GDP ( Figure 1 ) stems from persistent primary budget deficits and high net interest payments; the latter set to average around 12% of revenues between 2025 to 2030 ( Figure 2 ). This compares to around 7% for the UK, 5% for France and Belgium, and only around 2.5% for Germany. Since the average maturity of US Treasuries is low at 5.9 years, compared with an advanced-economy average of 7.2 years, higher interest rates impact debt dynamics relatively quickly.

Gross government financing requirements are high at 38% of GDP this year and will remain so, averaging 34% of GDP over 2026-30 – the highest of any Scope-rated sovereign borrower except Japan.

Figure 2: Significantly higher net interest payments compared with peers

% of government revenues

Mandatory Spending, Long-term Fiscal Pressures to Drive Budgetary Outcomes

Constrained budgetary flexibility limits the administration’s ability to offset higher expenditure needs with significant spending cuts or revenue increases. In 2024, mandatory spending, including on major healthcare programmes and Social Security, accounted for around 60% of federal spending. Discretionary spending, which is determined by Congress and the administration in the annual budget and appropriations process, accounted for around 27%, of which almost half relates to defence. Net outlays on interest represented around 13% of total annual spending.

Continued spending pressures, particularly from rising mandatory spending and outlays on interest will likely push the gross federal debt ratio to 169% of GDP by 2055, according to the Congressional Budget Office. This trajectory also reflects long-run ageing-related spending pressures. The IMF estimates a net present value of health care (112%) and pension (15%) spending of 127.5% of GDP over 2024-50, the highest projected burden among advanced economies .

President Donald Trump’s proposed reductions in discretionary funding for the fiscal year 2026-27, combined with higher-than-expected revenues from tariffs, are unlikely to significantly lower the budget deficit. Proposals include significant cuts to non-defence discretionary spending of 22.6%, or USD 163bn.

Still, with total government spending of USD 6.75trn in 2024, such spending cuts would represent only 0.5% of GDP. In addition, proposals to raise defence spending by 13% suggest that total discretionary spending will remain broadly unchanged. Additionally, new tariffs announced in April 2025 on “Liberation Day” could, according to estimates by the University of Pennsylvania’s Wharton School, generate around USD 145bn per year over the next decade (less than 0.5% of GDP).

Even if additional savings can be identified by reducing fraud and improper payments , significantly reducing the budget deficit through spending cuts would also require reductions in mandatory outlays. However, political constraints make such measures unlikely. In the absence of cuts to social security, Medicare or defence-related spending, stabilising the federal debt trajectory will prove challenging without new revenue-raising measures such as broad-based tax increases.

For a look at all of today’s economic events, check out our economic calendar .

Eiko Sievert is an Executive Director in Sovereign and Public Sector ratings at Scope Ratings GmbH .

This article was originally posted on FX Empire