The stock market's tech titans stumbled in the first quarter , but 2025 will still be another winning year for the Magnificent Seven, Goldman Sachs said.

In a recent note, chief equity strategist David Kostin projected that the mega-cap tech cohort will once again outperform the rest of the S&P 500 in 2025, extending a streak of stellar gains to a third straight year.

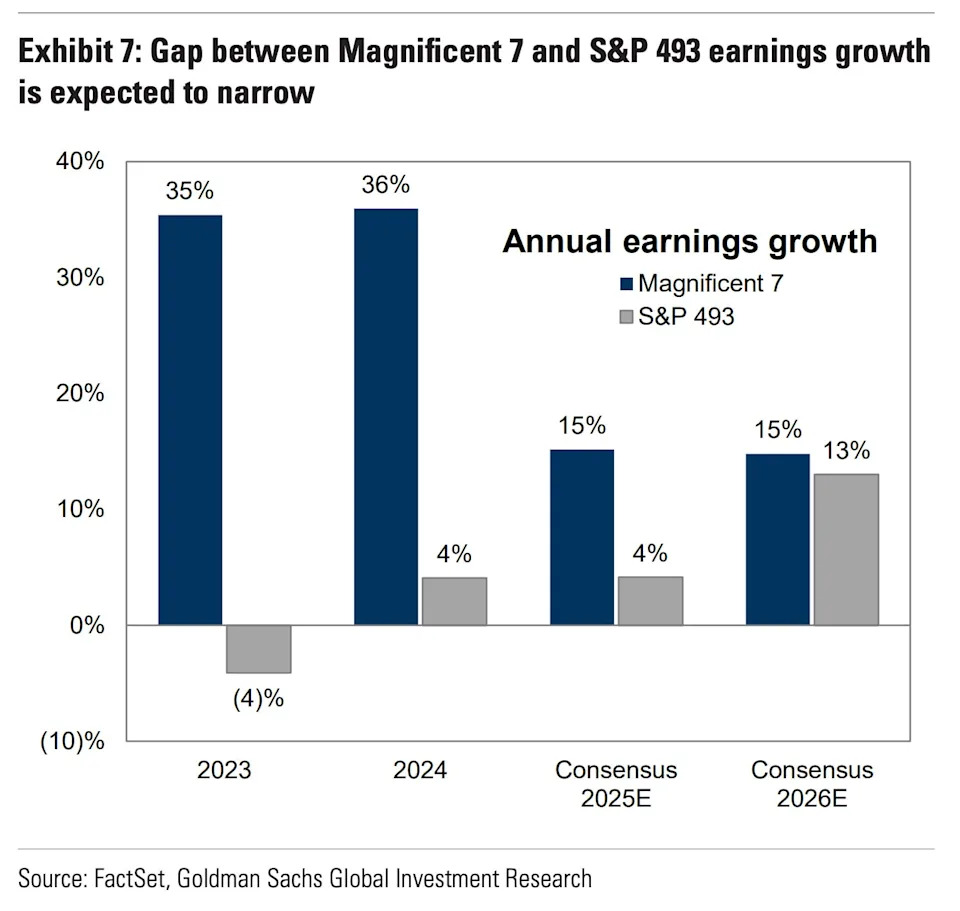

"We continue to expect that superior earnings growth will drive the Magnificent 7 to outperform the S&P 493 in 2025, but by a smaller magnitude than in recent years," Kostin wrote. "The share price outperformance of the Magnificent 7 has been tied to their earnings growth outperformance."

It's a take that might seem contradictory to what's transpired so far this year, as trade policy, AI disruptions , and antitrust moves have muddled the outlook for Big Tech.

The group, which includes Nvidia , Tesla , Meta , Amazon , Microsoft , Alphabet , and Apple , is down 5% year-to-date, trailing the 4% gain achieved by the broader index. Some big banks, such as Morgan Stanley, have called on investors to reduce tech exposure .

Ye, despite the slump so far, Kostin noted that mega-cap tech demonstrated earnings outperformance in the first quarter. In 2025, earnings-per-share growth has surged 28% for the Mag Seven, handily outpacing 9% for the S&P 493.

"This magnitude of surprise was the largest since the 2Q 2021 reporting season when the Magnificent 7 beat earnings estimates by 27%," the bank wrote. "Partly as a result of strong 1Q results, consensus 2025 earnings estimates for the Magnificent 7 are roughly in line with where they began the year."

What's more, the top tech stocks are now trading at a discounted valuation, resulting from narrowing earnings growth compared to previous years.

"The relative valuation is the lowest it's been in the last two years," Kostin told Bloomberg TV . "From a starting point of entry, it's actually looking somewhat more attractive at these levels."

Read the original article on Business Insider