The Sui blockchain is presently reeling from considerable panic following a targeted attack against its primary liquidity provider, Cetus Protocol.

The exploit extracted de facto control over SUI-denominated liquidity pools, compromising liquidity pools designed to maintain liquidity in the ecosystem. This led to widespread fund drainage and chaos in the marketplace.

The Cetus Protocol confirmed a theft of approximately $223 million, out of which it has successfully frozen $162 million. The team is working with the Sui Foundation and other ecosystem members to recover the rest of the stolen funds, it said.

On-chain analyst Lookonchain, on the other hand, estimated that more than $260 million has been lost. The exploiter is converting stolen funds into USDC and choss-chaining to Ethereum. The SUI/USDC pool was drained of around $11 million in liquidity.

As liquidity pools have evaporated, trading volumes have, and most trades on decentralized exchanges (DEXs) have begun to fail, leaving users incapable of either buying dips or exiting positions at all.

Overall market sentiment for tokens has turned sharply negative, and panic is spreading among SUI holders. The market confidence has been shaken to the core.

Binance co-founder Changpeng Zhao "CZ" wrote on X , "We are doing what we can to help SUI."

As the news of the Cetus exploit gained traction, the SUI token immediately fell nearly 10% to $3.82. It took some time to recover and was trading at $3.93 at the time of writing. The token is nonetheless still more than 63% up over a month.

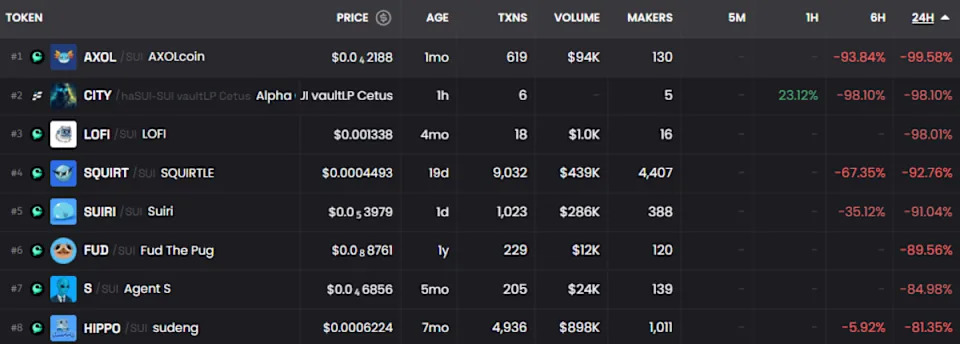

As per DEX Screener , SUI-based tokens plunged as much as 90% following the exploit.

However, it was the CETUS token that had a drastic free fall as it immediately dipped nearly 40% to $0.1586. The token was trading at $0.1755 at the time of writing.

Sui's largest DEX suffers massive $260M exploit first appeared on TheStreet on May 22, 2025