(Bloomberg) -- European bonds rallied after US President Donald Trump threatened to apply levies of 50% on the region starting June 1, fueling bets policymakers will have to lower interest rates further to support the economy.

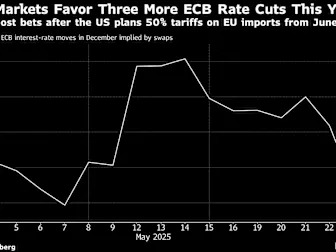

Money markets are pricing 65 basis points of additional easing from the European Central Bank in 2025, which implies three quarter-point reductions at the remaining five scheduled decisions is most likely. Traders favored just two cuts before Trump’s announcement.

The yield on 10-year German bonds fell as much as 10 basis points to 2.54%, European stocks extended their slump and the euro reversed gains against the Swiss franc and British pound. A gauge of the cost of insuring European junk-rated corporates against default jumped the most since April 9.

Trump said on Friday discussions with EU officials are “going nowhere.” Earlier this week, Bloomberg reported the EU had shared a revised trade proposal with the US as it aimed to inject momentum in talks, but there were signals the US was unhappy with the offer. Commerce Secretary Howard Lutnick on Wednesday said at an Axios event that some trade negotiations had proved “impossible.”

For investors, it’s the latest tariff-induced market volatility to endure amid Trump’s sudden back-and-forths on trade policy. Global markets were roiled by the US’s April 2 tariffs announcement, only for officials to pause most of those measures for 90 days later that month.

“It goes to show that the stabilization in markets had given Trump more courage to relaunch some aggressive tariff threats,” said Kristoffer Kjaer Lomholt, FX strategist at Danske Bank. “It’s a bad time going into the weekend so expect duration to rally and cyclically sensitive assets to selloff.

--With assistance from James Hirai, Naomi Tajitsu and Libby Cherry.

(Updates with comment, context and market moves throughout.)