(Bloomberg) -- Stock investors are starting to tune out President Donald Trump’s trade war.

After frantically pushing share prices higher and lower for weeks on each twist and turn in Trump’s tariff negotiations, investors are now largely ignoring new announcements. Last Friday, for instance, stocks barely budged after Trump said he’d just start imposing rates on many countries soon because his team didn’t have time to negotiate with them all. The same thing happened this week after news that the European Union shared a revised trade proposal with the Trump administration that included plans to gradually reduce tariffs to zero on many products.

The reason for the newfound nonchalance, market watchers say, is that many investors have concluded that Trump learned his lesson back in April, when the widespread rout in stocks, bonds and the dollar forced him to suspend much of his global tariff rollout. And as a result, the thinking goes, the final tariff plan he settles on will be far more modest than the initial plan he unveiled — not something, in other words, that they need to worry that much about. It’s the same optimism that’s helped stocks slowly grind higher these past six weeks.

“People have come to the conclusion that Trump’s bark is more than his bite,” said Marshall Front, chief investment officer at Front Barnett Associates LLC. “Investors think the tariffs will be much less aggressive than what they had thought earlier. I think the market is correct on that.”

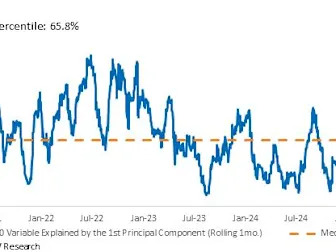

The S&P 500 Index’s sensitivity to tariffs has fallen dramatically since April, according to Dennis DeBusschere of 22V Research. The firm looks at market volatility using what is called a principal component analysis — a statistical exercise that crunches large sets of performance data of an index to determine which factor can best explain its move.

A little more than a third of the S&P 500’s daily move can be explained by tariff-related headlines — in line with a long-term median for any factor that can tip the market, the data show. That’s down from 80% in early April.

“There were a number of factors pressuring Trump that would lead to a milder tariff regime,” said Front. “The principal pressure came from the financial markets, you saw it in the widening of spreads between high and low quality bonds, in the volatility of the equity markets. He is not oblivious to these things.”

After the extreme stock gyrations that characterized much of April, investors have found a relative sense of calm in May.

The S&P 500’s daily swings got so intense in early April that the spread between the peak and the trough of daily moves were the widest since the 2008 financial crisis. Since then, however, the moves have returned to normal levels.

The trade truce between China and US, albeit temporary, has soothed nerves, and the US-UK agreement implies that progress is being made, however gradual it may be.

A Bloomberg Economics index that measures trade policy uncertainty has fallen drastically to levels prior to the unveiling of Trump’s tariffs after surging in early April. The gauge has been moving in lockstep with the S&P 500.

“The fear factor has been reduced substantially with respect to tariffs but there is no predictability,” said Front.

Macro Shocks

There are also other concerns that can rock markets such as the swelling US budget deficit after Moody’s Ratings stripped the US of its top credit rating. The downgrade was followed by a weak bond auction on Wednesday, which sparked anxiety about the demand for US Treasuries, sending bond yields higher and stocks lower.

Anything can become a major factor impacting the market at any given time. Take, for instance, Covid, which accounted for nearly 70% of the S&P 500’s volatility in 2020, according to 22V.

“Stocks are still susceptible to macro shocks here, but barring a shock, fundamentals are back to driving returns,” said Kevin Brocks of 22V.

The first-quarter earnings season has been better than feared, even though guidance was weak, and economic data also suggest that the expectations of dire outcomes seen in several sentiment surveys were perhaps too gloomy.

As a result, the market’s tendency to move in unison — commonly seen during times of major macro shocks — has also come down.

“We are transitioning to a backdrop with mixed data and mixed views,” said Michael Kantrowitz, chief investment strategist at Piper Sandler. “This should keep market correlations low, as stocks should trade more with micro fundamentals and not entirely on macro headlines like we saw earlier this year.”