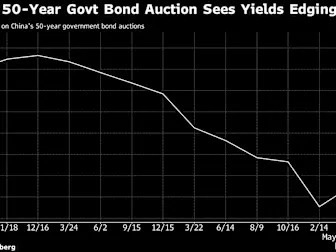

(Bloomberg) -- China’s 50-year sovereign bond auction saw a yield increase for the tenor for the first time since 2022, as government policy support and easing US trade tensions reduced demand for debt.

The Ministry of Finance sold the 50-year special sovereign notes at an average yield of 2.1% on Friday, according to traders who bid at the 50 billion yuan offering. That compares with a record low of 1.91% for the 50-year tenor that the last auction fetched in February.

The uptick in yields reflects lowered appetite for safe havens as investors welcome China’s trade-war truce with the US and policymakers’ efforts to put a floor under a growth slowdown. While the yield is ticking up, Chinese sovereign bonds more broadly have been spared volatility seen elsewhere in the world.

Sovereign yields have surged across major economies, from the US to Japan, amid growing investor concerns that governments may struggle to fund their massive budget deficits. The yield on 10-year US Treasury notes has risen from 4.16% to 4.53% since the beginning of May. Japan’s 10-year note yields have similarly spiked from 1.31% to 1.55% during the period.

A correction seen in China bonds is more contained relative to peers. China’s 10-year note has only risen from 1.63% to 1.7%.

The People’s Bank of China has rolled out a package of monetary stimulus, and the finance ministry has quickened debt raising since April. At least temporarily, bond bulls are slowing their downside bets on China.

Chinese cash bonds’ yields rose in long-term tenors, in response to the auction results. Yields on 30-year notes briefly rose past 1.9% for the first time in a week, while those on 50-year paper advanced five basis points to 2.04%.