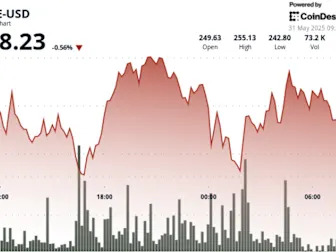

AAVE has demonstrated remarkable resilience in the face of global market turbulence, rebounding from a 15% price drop over four days as buyers stepped in to capitalize on DeFi’s growing momentum.

The protocol’s price climbed from $240 to above $250, buoyed by expanding tokenized yield markets that are drawing increased institutional and retail interest.

The price action comes as global trade tensions and new tariff uncertainties — including reports of China violating its trade agreement with the U.S. — injected volatility across risk assets.

Despite these headwinds, the DeFi sector is showing renewed strength, with total value locked (TVL) surging to $178.52 billion. AAVE remains a key leader in the space, commanding a TVL of $25.41 billion.

News Background

Technical Analysis Recap

As DeFi yield markets continue to expand, AAVE’s ability to integrate new products and sustain high-volume support levels positions it as a key player in the sector’s growth — despite the broader market’s macroeconomic challenges.