(Bloomberg) -- Oil inventories have risen sharply across the world in recent weeks, a sign of the pressure that higher output from OPEC+ could place on the global crude market as the year progresses.

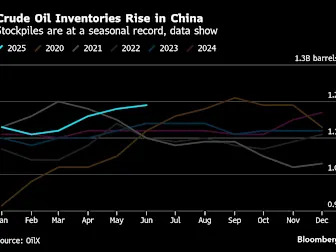

Crude oil stockpiles globally rose by about 170 million barrels in the past 100 days, according to Kayrros, which monitors inventories. Data from OilX, part of consultant Energy Aspects, shows they’ve been swelling since February.

Inventories matter because they offer clues on whether producers are pumping more or less crude than consumers need.

The Organization of the Petroleum Exporting Countries and its allies have announced successive plans to add oil back to a market at a faster pace than previously expected — without certainty that demand is strong enough. While physical markets have generally pointed to tight supplies in the first part of the year, the builds offer an indication that higher volumes of supply are finally beginning to be felt in global markets.

“We measure a big increase in global crude stocks, led by China but not confined to it by any means,” said Antoine Halff co-founder and chief analyst at Kayrros. Continued expansion of the country’s storage capacity, and the filling of that capacity has led the increase, “but there is also growing evidence of oversupply worldwide,” he said.

With substantial additions from outside OPEC+ — and risks to consumption from President Trump’s tariff policies — the producer group’s hikes have prompted the International Energy Agency to warn of oversupply for much of this year. Still in developed economies they’re rising from very low levels after years of decline thanks to OPEC+ cuts.

OPEC hiked supplies by about 200,000 barrels a day in May as the producer group embarked on its first month of later-than-advertised increases, a Bloomberg survey showed Tuesday. That figure doesn’t include contributions from the cartel’s allies, including Russia.

Some of the builds are likely accounted for by seasonal refinery work that quells appetite for crude each year.

But this year’s moves go beyond routine annual shifts. On average, OilX data show crude stockpiles growing at the fastest pace since 2020 in the three months through April, while the amount of crude oil sailing the world’s oceans recently hit the highest level since April 2024, according to Vortexa data.

In contrast to crude-stockpile builds, OilX saw declines in refined fuel inventories over February, March and April, while the US Energy Information Administration reported diesel inventories at the lowest level since 2005 last week.

That may encourage refineries to snap up and process crude to make refined fuels.

The second quarter of 2025 “has so far seen global crude inventories build 1.5 million barrels a day faster through the middle of May compared to the same period last year,” RBC Capital Markets analyst Brian Leisen wrote in a note. “We are just now beginning to see true physical sloppiness reflect consensus bearish balances.”

(Updates with OPEC production survey in seventh paragraph.)