Rachel Reeves has been urged to increase taxes and cut public spending as Britain’s growth was downgraded amid rising prices and Donald Trump’s trade war.

The Organisation for Economic Co-operation and Development (OECD) said “momentum is weakening” in the economy, as they told the Chancellor that efforts to cut government borrowing must be “stepped up”.

It poses a critical challenge to Ms Reeves as she must contend with growing demands for further big increases to public sector pay, the need for more defence spending and the Prime Minister’s about-turns on efforts to control benefits spending .

Britain’s economy is set to grow by 1.3pc this year, the OECD said, down from the 1.4pc it predicted in March.

GDP growth will slow further to 1pc in 2026, also below its prior projection of a 1.2pc expansion.

“Momentum is weakening, with business sentiment rapidly deteriorating,” the OECD said. “Consumer confidence remains depressed and has declined since the second half of 2024, while retail sales volumes have been volatile, with an uptick in March.”

Borrowing costs on the £2.8 trillion national debt have risen, the jobs market is slowing down and Ms Reeves’s own policies , including the £25bn raid on employers’ National Insurance contributions, have made the situation worse.

The OECD added: “Increases in the national minimum wage, in employer social security contributions and in utility bills kept services price inflation elevated, at 5.4pc in the year to April, and maintained substantial domestic price pressures, with consumer price inflation at 3.5pc over the same period.”

The Paris-based institution said the US president’s erratic tariffs policies had added to employers’ woes.

“Survey measures of new export orders have plummeted, as the aggregate effective tariff faced by domestic goods exporters in US markets is estimated to have increased by almost eight percentage points since the beginning of the year,” it said.

Savings blow

Amid the uncertainty, households are forecast to increase their already high savings levels. Although this may be a prudent position to take, it also risks undermining consumer spending, traditionally a powerful growth engine for the UK economy.

Last year households saved 10.1pc of their disposable income. The OECD predicts that will rise to 11.6pc this year and 11.7pc in 2026, unusually high levels.

It comes after the International Monetary Fund cautioned that the economy risked slowing further if households did not respond to lower interest rates by opening their wallets.

It leaves the Chancellor with less room to spend, even as Sir Keir Starmer reverses Ms Reeves’s decision to restrict winter fuel payments to the poorest pensioners, and considers removing the two-child limit on benefits .

“Fiscal prudence is required as the monetary stance is easing gradually,” the OECD said, a week ahead of the Chancellor’s spending review.

“Efforts to rebuild buffers should be stepped up in the face of strongly constrained budgetary policy and substantial downward risks to growth, while productivity-enhancing public investments should be preserved.”

It warned that Ms Reeves had left herself very little headroom to hit her fiscal rules, posing another risk to the economy.

“Currently very thin fiscal buffers could be insufficient to provide adequate support without breaching the fiscal rules in the event of renewed adverse shocks,” the OECD said.

Its economists propose both spending cuts and tax rises to repair the finances : “A balanced approach should combine targeted spending cuts, including closing tax loopholes, revenue-raising measures such as re-evaluating council tax bands based on updated property values and the removal of distortions in the tax system.”

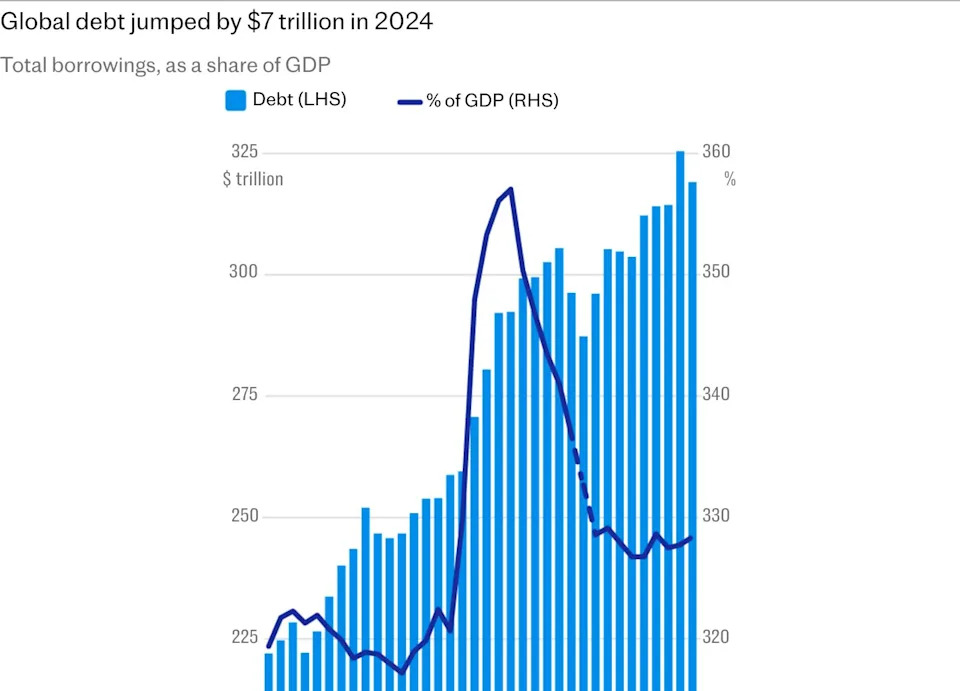

Global debt fears

It comes as global growth also slumps, as the OECD cut its forecast for this year from 3.1pc to 2.9pc.

The US economy has suffered a major downgrade, with France and China among those whose growth prospects are weakening on a similar scale to Britain’s.

OECD economists said governments everywhere must crack down on frivolous spending after several years of heavy borrowing.

“Stronger efforts to contain and reallocate spending and enhance revenues, set within credible medium-term country-specific adjustment paths, will be essential for debt burdens to remain manageable and to conserve the resources required to address longer term spending challenges,” the OECD said.

“Higher debt service costs and some pressing spending needs, such as plans to raise defence spending substantially, are already forcing hard choices in some countries about the pace and composition of fiscal adjustment and limiting room for budgetary manoeuvre.”

Responding to the OECD’s findings, the Chancellor said: “Delivering economic growth and improving living standards is my number one mission. That’s why we’ve securing landmark trade deals with the EU, US and India helping to cut costs for businesses, protect jobs and attract investment, we’re getting Britain building with our landmark planning reforms and investing in public transport to repair our creaking infrastructure.

“The UK was the fastest-growing economy in the G7 for the first three months of this year and interest rates have been cut four times, but we know there’s more to do.”

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.