Intermodal analyst Larry Gross says that normally he’d be able to draw on his 45 years of transportation experience to make predictions about freight volume in the months ahead.

“Theoretically, it would mean that I would be bringing some long-term insight to the situation that we find ourselves in today: You know, a sense that, well, the last time that this happened, here’s how it went,” Gross said Tuesday during an Intermodal Association of North America webcast.

But the past does not offer a road map for how intermodal traffic might perform while a trade war is raging. “There is no ‘last time’ for some of what we’re seeing right now,” Gross said. “It’s really a unique situation.”

Shippers pulled forward their imports, particularly from China, in an attempt to beat tariff deadlines, which sent international container volume higher beginning late last year. Then when the Trump administration imposed 145% tariffs on Chinese goods in April, trade all but dried up, creating an air pocket of container volume bound for the U.S.

Gross says he was surprised it took as long as five to six weeks for the air pocket decline to hit U.S. railroads. “We’ve only really seen it now for the past two or three weeks,” he said of BNSF and Union Pacific (NYSE: UNP) intermodal volumes.

Now, with tariffs on Chinese goods reduced to 30% from May 12 through the middle of August, Gross is expecting a mini-surge in volume to begin in the middle of this month. “It’s not going to be … a huge volume, because even though 30% is a lot lower than 145%, it’s still pretty significant,” Gross said of tariffs on Chinese goods.

The hold on reciprocal tariffs, which vary by country and will remain in effect until at least July 9, means importers of goods made elsewhere also may try to rush containers to the U.S., he says.

What happens to volume after these summer tariff-related deadlines depends on the next steps in trade talks. But it’s trade with China, Gross says, that will have the biggest impact on U.S. intermodal volumes.

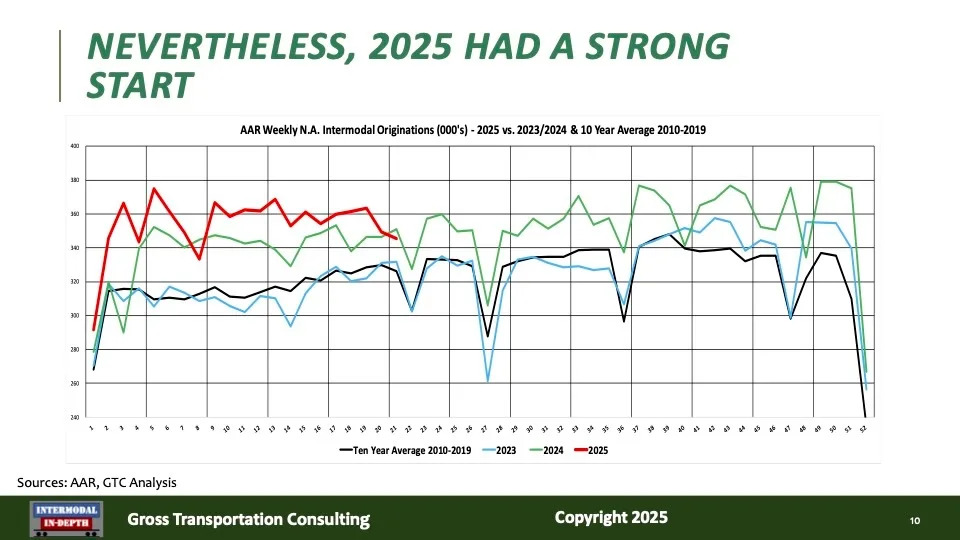

Intermodal makes up roughly half of all U.S. rail traffic. And North American volumes this year are running well ahead of 2024 levels as well as the 10-year average. U.S. intermodal volume is up 7% this year through May 24, while North American volume is up 5.8%, according to Association of American Railroads data.

Overall, 41.3% of U.S. containerized imports come from China, Gross says, citing S&P Global PIERS data for 2024. Chinese imports make up 57.5% of containers handled by U.S. West Coast ports but just 25.6% of boxes that land at U.S. East Coast ports and 34.7% at Gulf Coast ports.

“To the extent that we have a trade war with China, the West Coast is going to feel it much more acutely than the East Coast,” Gross said.

Making matters worse for the West Coast: Asian trade is flowing back to normal routings involving East Coast ports for two reasons. First, shipments were diverted to the West Coast last year amid labor uncertainty and a brief strike at East and Gulf Coast ports. Second, some shipments shifted to the West Coast to avoid danger on their normal route via the Red Sea, which was under threat by Houthi rebels in Yemen.

This means that both international and domestic intermodal volume from Southern California will face headwinds after the mini-surge, Gross says. Some 15% of domestic container shipments out of Southern California carry goods that were transloaded from international containers, he estimates.

This is bad news for BNSF and UP, which originate intermodal loads from West Coast ports. But it’s not necessarily good news for Eastern carriers CSX (NASDAQ: CSX) or Norfolk Southern (NYSE: NSC) because the intermodal share of imports is much lower at the East Coast ports they serve.

It’s unclear when trade disputes will be ironed out, Gross says, but he doesn’t expect agreements to fall into place quickly. And that, he says, will mean lingering uncertainty for businesses and consumers alike. “Uncertainty is the enemy of growth,” Gross said.

Slowing growth, plus the potential for tariff-fueled inflation, could ultimately produce stagflation that will reduce consumer demand, he says. “It certainly wouldn’t surprise me to see a downturn in the second quarter and third quarter of this year,” Gross said.

Still, he expects domestic intermodal to eke out slight year-over-year gains for 2025 – if intermodal can continue to slowly regain market share from trucking. International volume, Gross says, likely will be flat to down this year.

“I certainly view more downside risk in that forecast than upside potential,” he said.

The post Predicting the unpredictable for intermodal appeared first on FreightWaves .