Via Metal Miner

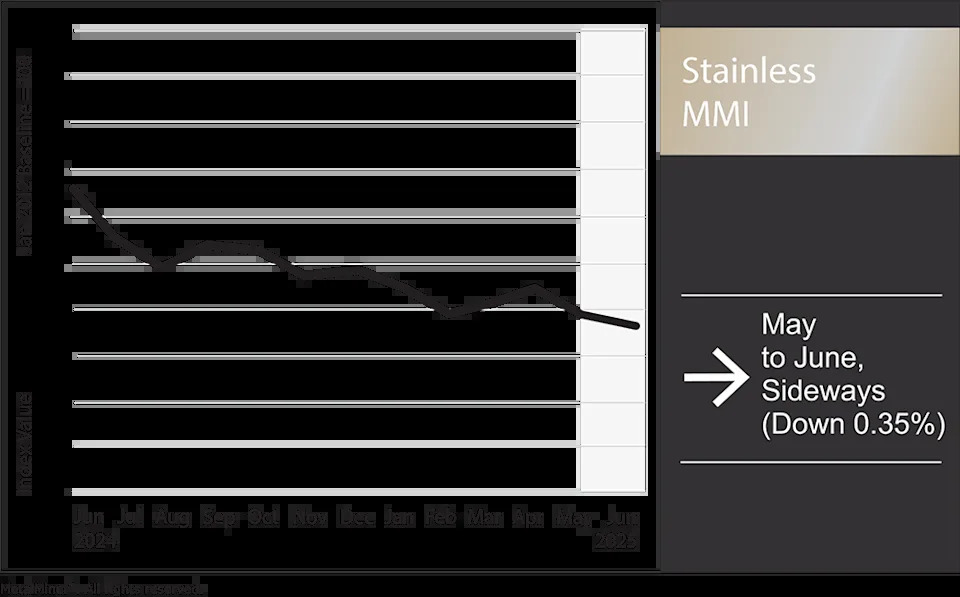

The Stainless Monthly Metals Index (MMI) moved sideways, rising by a modest 0.35% from May to June. However, the stainless steel price remains under pressure from several factors.

Tariff Hike Rattles the U.S. Stainless Steel Market

In a move few saw coming, President Trump doubled Section 232 tariffs on steel and aluminum imports from 25% to 50%. The duty increase took effect on June 4, just days after its announcement, leaving both suppliers and buyers with no real window to prepare.

The tariff increase proved controversial, drawing concern from many industry experts. According to stainless analyst Katie Benchina Olsen, “The U.S. flat-rolled stainless steel market has always required imports to satisfy the market demand. In some years, import penetration exceeded 30%, with steady state hovering around 18%.” Because of this reliance, the “rapid implementation of a 50% tariff is wreaking havoc on the stainless steel industry. This, in turn, seems destined to also impact the stainless steel price.

Advertisement: High Yield Savings Offers

Already, importers of products that U.S. mills cannot support are having to go back to their customers for the second time this year to adjust pricing. This is material that the customer has to accept to pay the 50% tariff.” Don’t miss the next tariff adjustment. Opt into MetalMiner’s free weekly newsletter.

How Stainless Mills are Responding to Tariffs

As those relying on imports get pinched by the tariff hike, the quick implementation of such a significant increase in duties also poses considerable risks for stainless steel price stability from domestic producers. The only reprieve to the tariff hike seems to be the weak market conditions, which have plagued the industry for over a year. This might explain why U.S. mills have yet to adjust prices, as market oversupply, at least for now, remains a limiting factor.

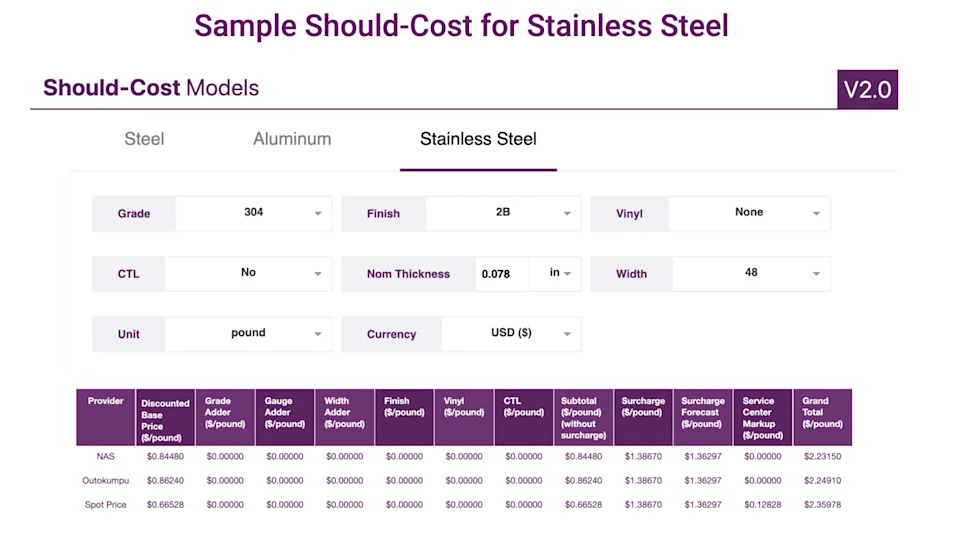

Depending on how long tariffs last, a lot could change. Higher duties will allow domestic producers to prioritize more favored grades of stainless, including common grades like 304, which represents the bulk of demand. This means most buyers will not face shortage risks, especially as common austenitic grades like 304 experienced oversupply conditions ahead of tariffs. However, the same could not be said for ferritics, where supply continues to appear increasingly tight.

Some Stainless Grades May Feel the Pinch

While 304 will remain readily available to buyers sourcing domestically, other grades will likely prove less lucky. As mills prioritize material like 304 to fill capacity, they will likely turn away other orders more often.

Some of this behavior has already started to occur. Ahead of tariffs, Outokumpu’s discount adjustment released in February increased prices for a number of stainless grades the mill prefers not to produce. By late May, NAS had reportedly started to turn away orders for bright annealed.

Tariff Adjustments May Be on the Way

While mills will likely remain sensitive to demand destruction, price increases will probably follow in the coming months, assuming tariffs stick around. However, some argue that the latest tariffs may prove more temporary than some might expect.

Although part of the Trump Administration’s intention is to support domestic producers, trade negotiations still represent the larger goal. As MetalMiner’s Stuart Burns points out , “the Trump administration announced the UK would not face the additional 25% increase to 50% on steel and aluminum while negotiations continue.” This decision likely serves as a cue to other countries looking to secure a new trade deal with the U.S.

Stainless Steel Prices Just Part of the Bigger Picture

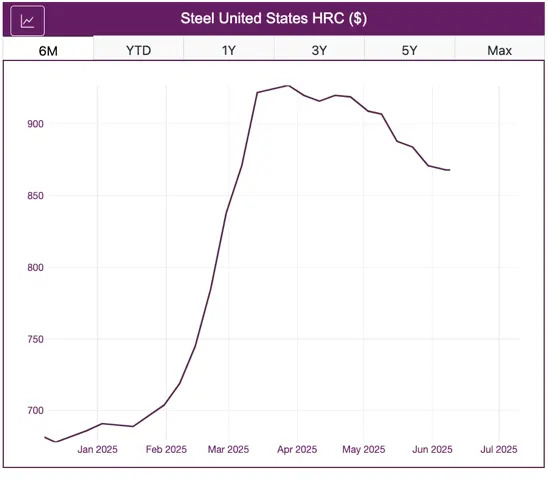

Aside from stainless, the tariff exemption appeared to temper the impact of the tariff hike on other markets. Carbon steel prices remained bearish in the following days. This signals that markets anticipate further tariff changes and reductions in the coming months.

While deals may begin to roll in and offer relief to stainless steel buyers, it is worth noting that supply conditions are still likely to change. Countries like Vietnam and Indonesia, the biggest culprits in suppressing global stainless steel prices, are unlikely to secure exemptions or quotas.

Meanwhile, lackluster demand conditions will help mitigate the impact of higher duty rates in the short term. However, reduced supply from the cheapest Asian producers—primarily responsible for dragging the global price curve lower—will inevitably offer more leverage to domestic producers with regard to stainless prices.

By Nichole Bastin

More Top Reads From Oilprice.com

Read this article on OilPrice.com