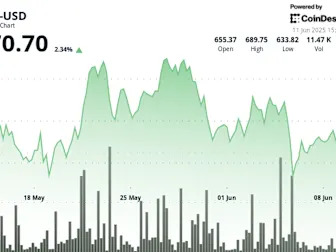

Binance’s BNB token moved higher in the last 24 hours, defying broad market unease driven by geopolitical and economic crosswinds.

The coin gained 1.75%, rising from $659.72 to $670.91, as investors monitored resistance levels near $674 for signs of a breakout.

The token’s performance comes amid the backdrop of a U.S. Consumer Price Index (CPI) report showing inflation came in lower than expected in May, boosting risk asset prices, with the S&P 500 moving up 0.3% in today’s session so far, and the NASDAQ rising 0.4%. Meanwhile, CoinDesk 20, a broader digital assets market gauge, rose 2.6% in the last 24 hours.

BNB has been posting higher lows that suggest accumulating interest even as volatility persists.

Bitcoin, the market’s bellwether, is hovering around $109,800 after bouncing back from last week’s retreat. On-chain data shows growing wallet activity consistent with accumulation phases, hinting that long-term holders may be taking advantage of dips.

Technical Analysis Overview

BNB traded within a narrow $8.12 range on the day, with buying pressure being strongest between 06:00 and 12:00 UTC, according to CoinDesk Research's technical analysis data model. Volume during this window exceeded the 24-hour average of 41,757 tokens, supporting the upward move.

Despite testing resistance around $673.67 several times without success, the token held support near $667.50. A sharp two-minute correction at one point briefly knocked the price from $669.87 to $667.35 on heavy volume. However, it quickly stabilized, potentially suggesting the sell-off lacked conviction.

BNB is now floating above $670, maintaining a bullish structure defined by higher lows. Traders now look for a clean break above $674 for a potential signal for the next leg higher.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .